How to Choose the Best Provider When Setting Up or Reviewing a Pension

Planning for retirement can feel like navigating through a maze. With so many options available, it’s easy to get lost in the details. One of

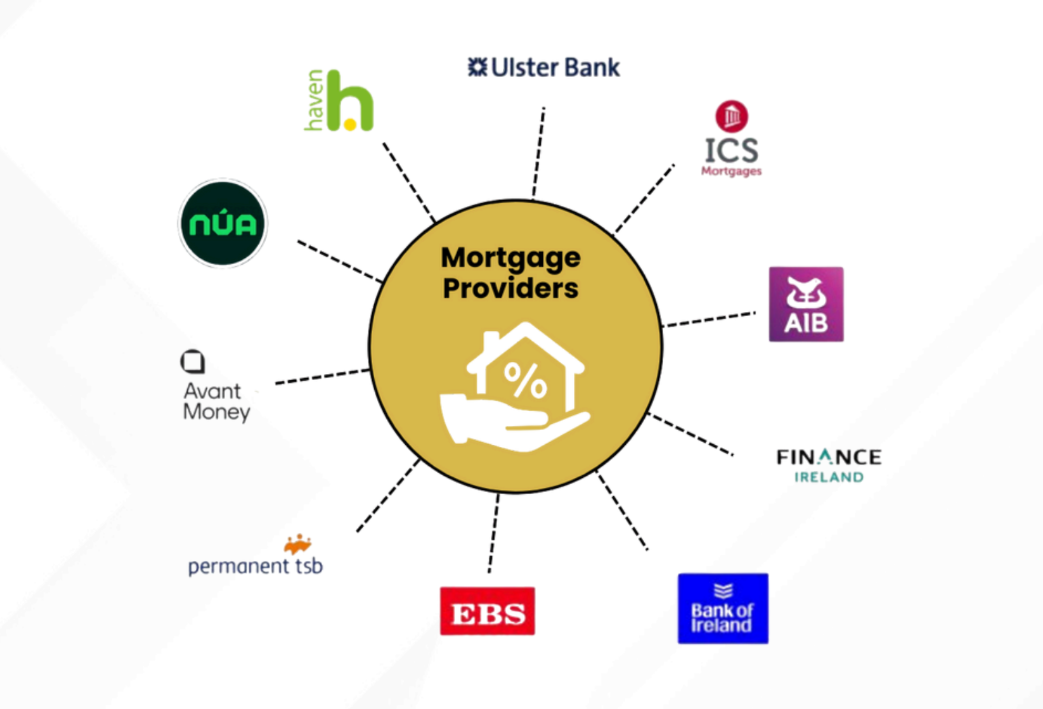

Buying your first home, trading up, or simply switching providers? The mortgage world can be complex, full of jargon, changing rates, and limited offers. That’s why we compare the market for you, ensuring you get the best deal, lowest rate, and maximum value, without the stress.

🔸 Access rates, terms, and incentives from all top lenders in Ireland.

🔸 Find the most competitive deals available based on your profile.

🔸 Maximise Your Borrowing Power.

🔸 Our service is 100% free; the lender pays us.

🔸 We work for you, not the banks – no allegiance to any provider.

🔸 We manage the paperwork, negotiations, and process on your behalf.

🔸 Review and change your mortgage to save money with ease.

🔸 Simplify Complex Mortgages.

🔸 Guidance on Help to Buy, First Home Scheme, and more.

Why settle for one bank's offer when you can view all of Ireland’s top mortgage lenders side by side?

Choosing a mortgage can be as important as choosing a home. With interest rates, terms, and offers varying across providers, comparing the market helps buyers:

Each type includes distinct eligibility criteria and benefits, suitable for different life stages and goals.

Guidance is available to help applicants access:

Step 1: Initial consultation to gather personal and financial information.

Step 2: Comparison of all major Irish lenders on:

Step 3: Recommendation of the most suitable mortgage product.

Step 4: Full application handled on behalf of the applicant.

Step 5: Coordination with banks, solicitors, and valuers.

Step 6: Education on applicable grants and government schemes.

Unlike others, Money Maximizing Advisors doesn’t charge any broker fees. We’re paid directly by the lender only when your mortgage is successfully drawn down. That means:

A multi-agency broker compares all offers on the market, including those from banks, credit unions, and private lenders.

Ans: There’s no one-size-fits-all answer. The best mortgage depends on your income, deposit, and whether you’re a first-time buyer. That’s whymortgage comparisons in Irelandare so valuable. Brokers like MMAdvisors compare offers from all major lenders, including alternative and non-bank providers, to find the best mortgage rates Ireland has to offer, tailored to your unique profile.

Ans: They are available, but not as widely offered as shorter-term fixed rates. Most fixed-rate mortgages in Ireland range from 3 to 5 years, but some lenders now offer longer-term products. At MMAdvisors, we help you find lenders offering mortgages with interest rates in Ireland that suit your long-term goals, including extended fixed terms if available.

Ans: This depends on your loan size, interest rate, and term. For example, a €300,000 mortgage over 30 years at 4% interest may cost around €1,432 per month. Use a free tool like the Irish Mortgage Calculator or speak to a broker to calculate the exact cost for your situation.

Ans: Absolutely. A broker gives you access to multiple lenders, not just one bank, meaning you can secure the cheapest mortgage rates in Ireland for your needs. Plus, MMAdvisors charges no broker fee. We’re paid only when your mortgage is successfully drawn down.

Ans: Here are the basics:

Brokers like MMAdvisors simplify these rules and help you apply online for mortgage loans in Ireland—guiding you from pre-approval to final drawdown.

Ans: Rates change regularly and depend on your deposit size, income, and lender. Some providers offer cashback; others offer lower rates with fewer perks. With full mortgage comparisons in Ireland, we help you weigh total repayment costs, not just the headline rate, so you can choose the right product.

Ans: Forecasts are uncertain, but experts suggest Irish mortgage rates may begin to stabilise in 2025, depending on European Central Bank (ECB) policy. That said, holding off may result in greater expenses if rates continue to be high. Locking in a competitive rate now, then switching later, may be a smarter move, especially for first-time buyers.

Ans: A 35-year mortgage lowers monthly repayments, making it attractive for younger buyers. However, a 25-year mortgage typically means lower overall interest paid.

Planning for retirement can feel like navigating through a maze. With so many options available, it’s easy to get lost in the details. One of

Whether you’re just curious or ready to apply, we’re here to help.

Money Maximising Advisors Limited is regulated by the Central Bank of Ireland C154250.