Main features and benefits of this Plan

- Quick and easy process

- Apply online in minutes

- View your savings plan online on your phone/laptop at the click of a button

- Full control over your savings plan

- Lump sum and regular contributions accepted

- Fund choice available for all risk levels (low, medium or high)

- Very competitive fees and charging structure (see below)

- Flexibility in relation to accessing your funds

Why start a Children’s College Education Savings plan?

- A Children’s College Education Savings Plan will help relieve some of the financial pressure of putting your children through college when the time comes.

- Small regular consistent monthly contributions over a long period of time can accumulate quite a large pot of money to cover the huge financial cost of putting your children through.

- Your savings are losing money on deposit in your local bank or credit union.

- It’s only a matter of time before banks start charging you negative interest rates to hold your money.

- Why not try and get a return that will at least cover the cost of inflation.

How much should I save?

The main benefit of saving for your children’s education is that you will have a nest egg stashed aside to pay for the ever-increasing third-level education costs. It is estimated that it takes close to €10000 per year to pay for a child’s third-level education. The average college course is 4 years so, roughly speaking, it can cost up to €40000 to put each child through college. ‘A recent study undertaken by Zurich in 2020 indicated that 41% of households got into debt as a consequence of their children going to college’

The key to preparing for your children college education

- Start early and contribute regularly

- Try not to withdraw from the fund if possible as it is for your children’s third-level education

- Every little helps so save what you can when you can

- As your children’s allowance is paid each month, try and put as much as is affordable into this plan.

Saving your monthly Children's Allowance

If you saved the children’s allowance of €140 per month until your child’s 18th birthday, you would have close to the €40000 saved. Please see below the potential returns expected with saving the Children’s allowance for one child and while also generating a modest 3.4% annual return on investment.

If you can’t afford to save all of your full children’s allowance or if you have no savings and your child is in his teenage years, it’s never too late to start. Whatever you save for college education costs, you will be grateful for this pot of money when the time comes.

Fees and Charges

- You get 101% allocation on all funds transferred into this plan. This means that for every €100 euro you invest into the plan, Zurich will contribute €1 on your behalf. So in effect €101 is invested.

- There is a standard 1% government Levy taken from contributions into savings plans in Ireland.

- There is a 1.25% Annual Management Charge on the fund value each year. This is quite competitive when compared to other charges across other savings plans in banks/other providers etc.

- However, if you also transfer over €7500 initially into the savings plan, the Annual Management Charge is reduced to 1%.

What potential returns I should be expecting?

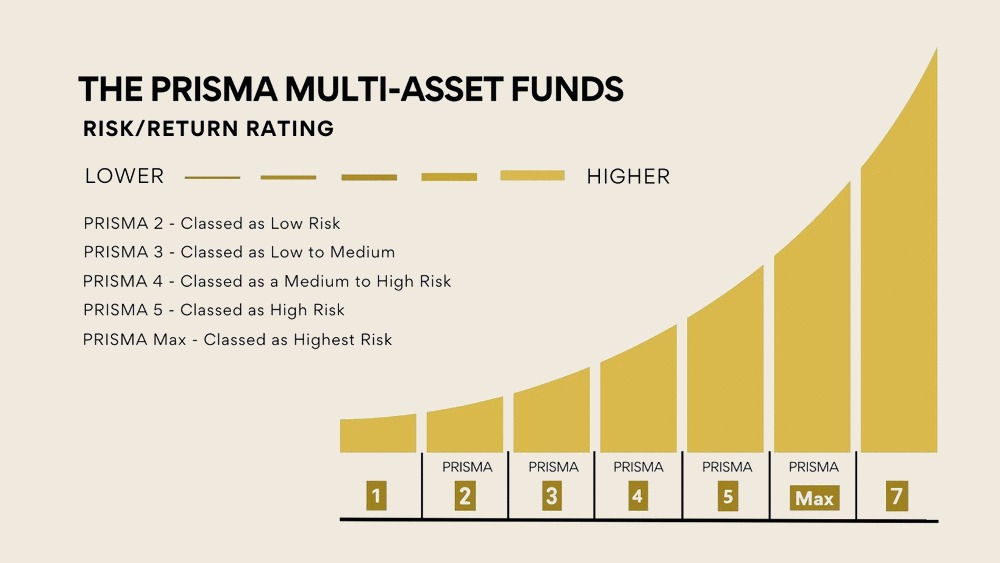

The Potential returns all depend on what PRISMA funds that you choose. If you are a low-risk, conservative investor then PRISMA 2 is for you. If you would like to take on more risk and potentially get more of a return on your money, then PRISMA 4, 5, and Max are the funds for you. As you can appreciate, the lower the risk of the fund you choose, the smaller the potential returns will be and the higher the risk you take, the higher the potential return that could be earned. However high-risk funds can be volatile and may go up and down more frequently.

Need help with your PRISMA Fund choice?

If you are struggling to make a decision as to what PRIMA funds to invest in, you can take a test below which will categories your tolerance to risk. The results will give you an indication of what funds you are most suited to (low, medium, or high). The test is 7 short multiple-choice questions.

Have I access to my savings?

The main purpose of Children’s Education Plans is that you put money aside for a long-term period (minimum 5 years or so) to cover the huge cost of third-level college education. If you plan to withdraw funds regularly, this plan is not for you. However, you can if you wish take part withdrawals from the plan. In the initial years of the plan, there may be a slight penalty on your funds if you do withdraw funds.

Steps in setting up this Savings Plan

1- Click on the ‘Apply Now’ button, fill in Zurich’s application form and submit.

2- Accept a confirmation email from Zurich with your application form details.

3- Upload Proof of ID (passport/driver’s License), Proof of Address (utility bill less than 3 months old) and Proof of PPS (payslip/any revenue documentation)

4- Transfer any lump sums by electronic transfer (EFT) into Zurich’s Bank account (details are sent to you via email).

5- Start paying the monthly Premiums.

All Savings plan documentation is sent in the post within a couple of weeks to you.

You will receive your Login details to Zurich’s savings plan online portal also in the post.

Here you can,

- View your account balance.

- Transfer additional funds if required.

- Increase/decrease/stop your monthly contribution.

- Adjust/change your investment fund choice.

An Annual Benefits Statement is sent in the post to you on the anniversary of your plan.

Your plan will be analysed by one of our Qualified Financial Advisors via zoom call on the anniversary of the savings plan.