What is Serious Illness Protection?

Serious illness cover provides a tax-free lump sum if you are diagnosed with a serious illness during the term of the policy.

Here is a list of the main illnesses covered:

Cancer, Heart, Stroke, Alzheimer’s Disease, Chronic Rheumatoid Arthritis, Motor Neurone Disease, Multiple Sclerosis, Paralysis of a limb, Parkinson’s Disease etc. * Full details of Specified Serious Illness Cover and the Terms and Conditions which apply are contained in the relevant Policy Conditions.

Why the need for Serious Illness Cover?

Serious illness policies provide you with a tax-free lump sum in the event of you being diagnosed with one of the specified serious illnesses covered on your policy. There are over 50 specified illnesses covered and partial payouts for over 20 specified illnesses. Serious illness cover can be combined with life cover under the one policy.

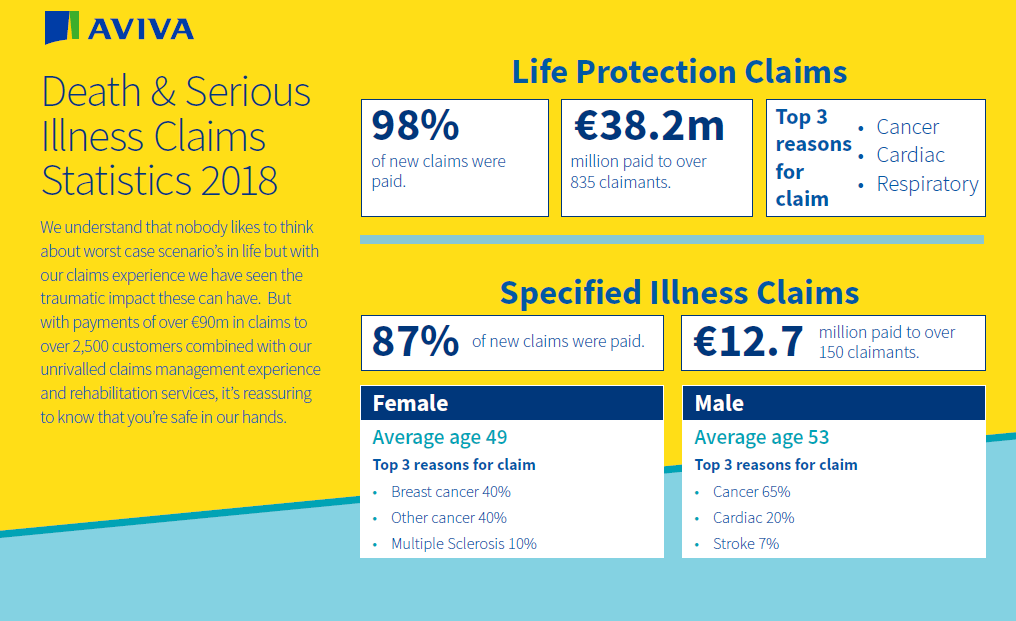

Serious Illness Cover Claim Statistics

Unsure if Serious Illness Protection is the right choice for you? Don’t know what is a fair monthly premium to expect? Questions about the process?

We’re here to help! You can use our chat box in the bottom corner to speak to a Financial Advisor at no cost. We also have frequently asked questions below that you can have a read through.