What is Funeral Cover?

Taking out Life Insurance in your 50s can ensure that a lump sum of money is left to your loved ones when you die to cover the costs of your funerals and to give you a good send-off.

The average cost of a Funeral Cover nowadays can range up to €30,000 with coffin, burial plot and headstone, along with refreshments after your burial. Someone will have to pay for this, why not have a life insurance provider pay for it instead of your family having to?

The cost of this plan will depend on how much money you would like to leave behind.

Why get over 50's Funeral Cover?

- Leave a pleasant financial surprise behind for your loved ones

- Cover the costs of your funeral (Coffin, tombstone, burial plot)

- Pay for refreshment on your funeral day for your close friend and family and give yourself a good send-off.

- Leave the feeling of generosity, unselfishness and gratitude behind.

Over 50s Funeral Cover- How it works

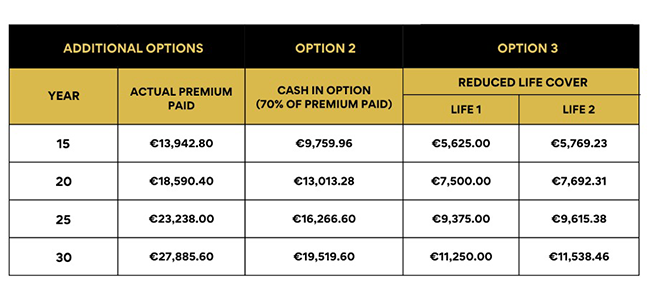

You choose how much cover you would like and whether it is a single or dual life policy (two people). This policy has a huge flexibility in relation to its payout options. The diagram below explains the 3 main options:

Over 50s Funeral Cover- How it works

You choose how much cover you would like and whether it is a single or dual life policy (two people). This policy has a huge flexibility in relation to its payout options. The diagram below explains the 3 main options:

From year 15 onwards, you have the option of either;

- keep paying premiums until death,

- cash in your policy and get up to 70% of your premiums back,

- stop paying the premiums and settle for a reduced life cover payout that will pay on your eventual death.

Know the future of investment

Summary of the main points of the this policy

- Once the first premium is paid, this policy guarantees that the funeral cover sum insured will be paid out on death for the life(s) insured.

- This sum of money is paid to your estate on death. They don’t necessarily need to spend the funds on funeral expenses…..its their choice.

- If you keep paying the premium for 15 years or more, the policy will guarantees to paid out a sum of money. What is paid out depends on which option you choose (explained above).

- The premiums stay the same for the duration of the policy (unless the indexation is chosen).

- The premiums quoted above are subject to your application being accepted at standard rates. Ongoing health issues may increase premiums.

Money Maximising Advisors Ltd are regulated by the Central Bank of Ireland C154250