What is Life Time Loans?

Life Time Loan is a type of equity release product that allows homeowners aged 55 and above to access tax-free cash from the equity of their homes without having to sell them. The loan is secured against the home’s value, and the borrower does not have to make any monthly repayments. Instead, the interest on the loan accrues over time, and the loan is repaid when the borrower dies or moves into long-term care.

Benefits of Life Time Loans

- Tax-free cash: The cash received from a lifetime loan is tax-free.

- Flexibility: Borrowers can choose to receive the cash as a lump sum or a series of payments.

- No monthly repayments: Borrowers are not required to make monthly repayments.

- Retain homeownership: Borrowers can continue to live in their homes.

Eligibility Criteria

- Age: Must be 60 or older

- Homeownership: Must own your home outright

- Equity: Must have sufficient equity in your home

- Financial situation: Must have a good credit history and a manageable income

- Ireland Citizen: Must be a Citizen of Republic of Ireland

Frequently Asked Questions

Do I continue to own my property?

Yes, you still have full ownership of your property and continue to live in it for as long as you wish.

What is Equity?

Equity is the value of assets after debts are paid. In the context of your home, equity is the current market value of your house less any amount you owe on it. For example, if your house is worth €400,000 and you owe €100,000 on a mortgage, then you have equity of €300,000 in your home.

Why switch to a Lifetime Loan?

There are many reasons an equity release solution like a Lifetime Loan may be appealing. Here are some of the most common reasons we see people switching their existing mortgage to a Lifetime Loan:

- To reduce or manage unaffordable monthly mortgage repayments.

- For certainty around interest rates. As the Lifetime Loan interest rate is fixed for life it will never be subject to increase.

- To repay the lump sum amount due on an interest-only mortgage.

- To pay off an existing mortgage and also raise funds for other purposes.

- Where they have been unable to refinance with traditional lenders because of their age or a previous credit issue.

Are there any loan repayments required?

No, there are no regular repayments required. Repayment is only required after you die, permanently cease to reside, or when you sell your house.

What happens if I want to move house?

You remain the owner of the house so you are entitled to sell it and move to another one at any time. However, a number of practical issues arise:

- If you sell the house the loan becomes due for repayment.

- You may request to transfer your loan to the new house instead, subject to the usual lending criteria (age and house value), but you must tell in advance. If the new property is worth less than the original one you may be required to repay some of the loan.

- If there would be insufficient funds to repay the loan after selling the house and buying a new one, you may not be able to move unless you have alternative funds to repay the loan (or part of the loan in a transfer situation).

Switch Mortgage to Life Time Loan

Whether your existing mortgage is variable, fixed rate, or interest only, it may be possible for you to refinance to a Spry Finance Lifetime Loan and access some of the equity built up in your home at an interest rate that is fixed for life.

How much can be borrowed?

Minimum Loan Amount

Having regard to the fees and other costs which arise when taking out a Lifetime Loan, the smallest amount you can borrow is €20,000.

Maximum Loan Amount

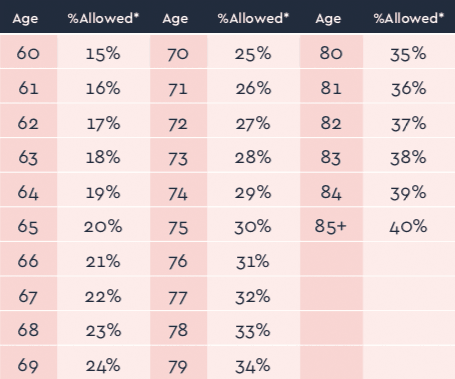

This depends on the value of your property and your age at the start of the loan. The table below will guide you.

For example if you are 60 you may borrow 15% of the value of the property but if you are 85 or older you may borrow 40%.

Overall Maximum

Irrespective of age or property value, the overall maximum amount that can be borrowed is €500,000.