Get The Lowest Prices Available in Ireland – Guaranteed

We have agency agreements with the following insurance companies for Insurance purposes;

Types of Insurance We Offer

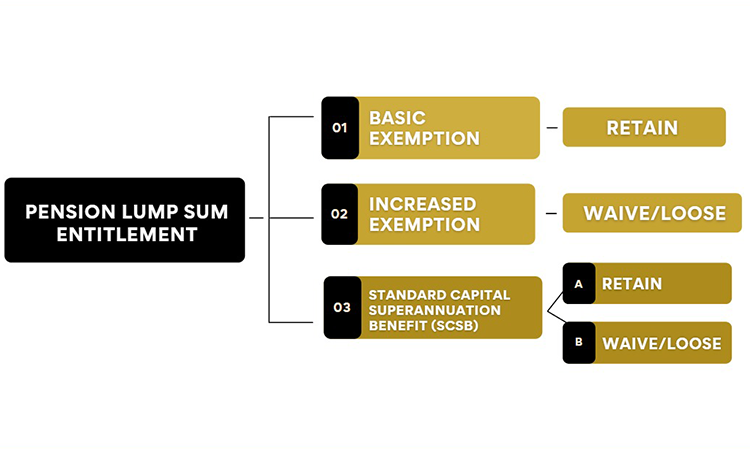

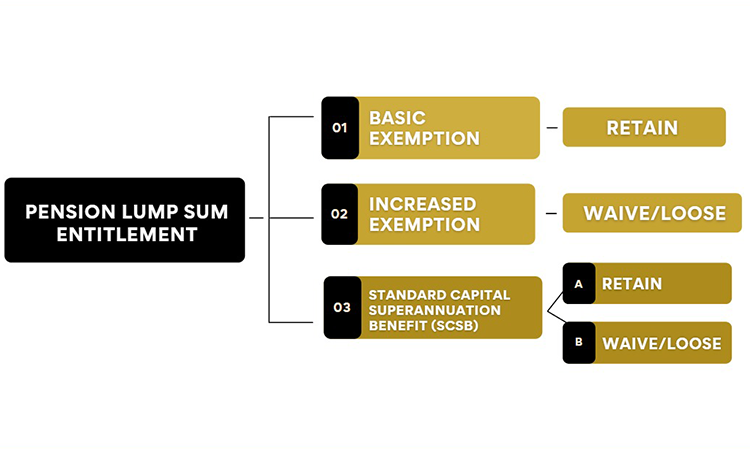

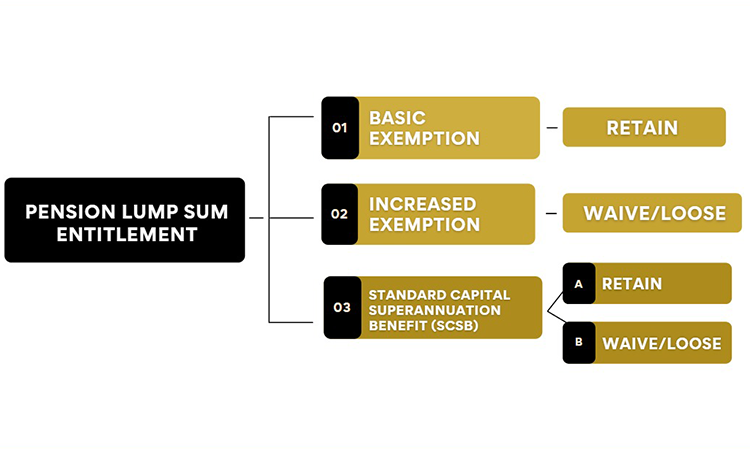

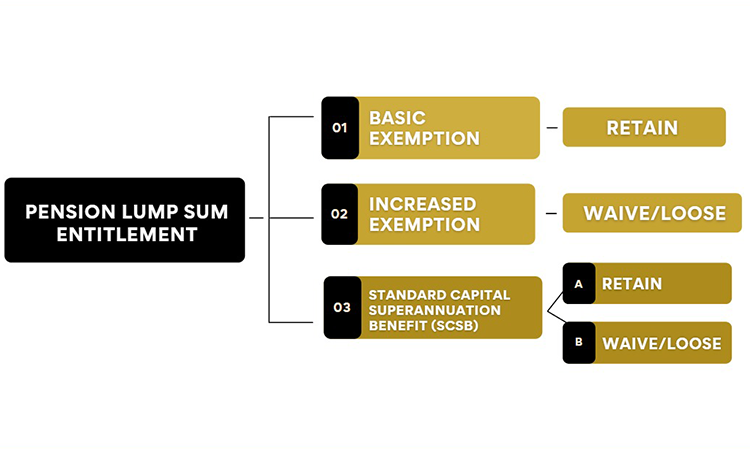

These 3 options are as follows

- Basic Exemption

- Increased Exemption

- Standard Capital Superannuation Benefit (SCSB)

Ex Gratia Option and its implication on the employees’ Pension Entitlement

Income protection is a simple, tax efficient and inexpensive plan that provides you with a source of income if you are unfortunate enough to be out of work because of an illness and suffer a loss of earnings as a result of any disability, any injury or any accident.

Redundancy and Pension Entitlements

Life cover pays out either a lump sum or an income in the event of your death. Life Cover is purchased by individuals who want their family to receive a lump sum of money if they die prematurely. The money can be used to ease the financial burden on a family after bereavement.

Pension Transfer options - Defined Benefit vs Defined Contribution

Serious illness policies provide you with a tax-free lump sum in the event of you being diagnosed with one of the specified serious illnesses covered on your policy. There are over 50 specified illnesses covered and partial payouts for over 20 specified illnesses.

Consequences of waiving the right to a Pension Tax-free Lump Sum with a Redundancy package.

Mortgage protection is life insurance that pays off your mortgage in the event of your death.

The sum of money that is insured under a mortgage protection policy reduces down each year in line with your mortgage balance outstanding. So as your mortgage reduces, so too does your mortgage protection insurance.