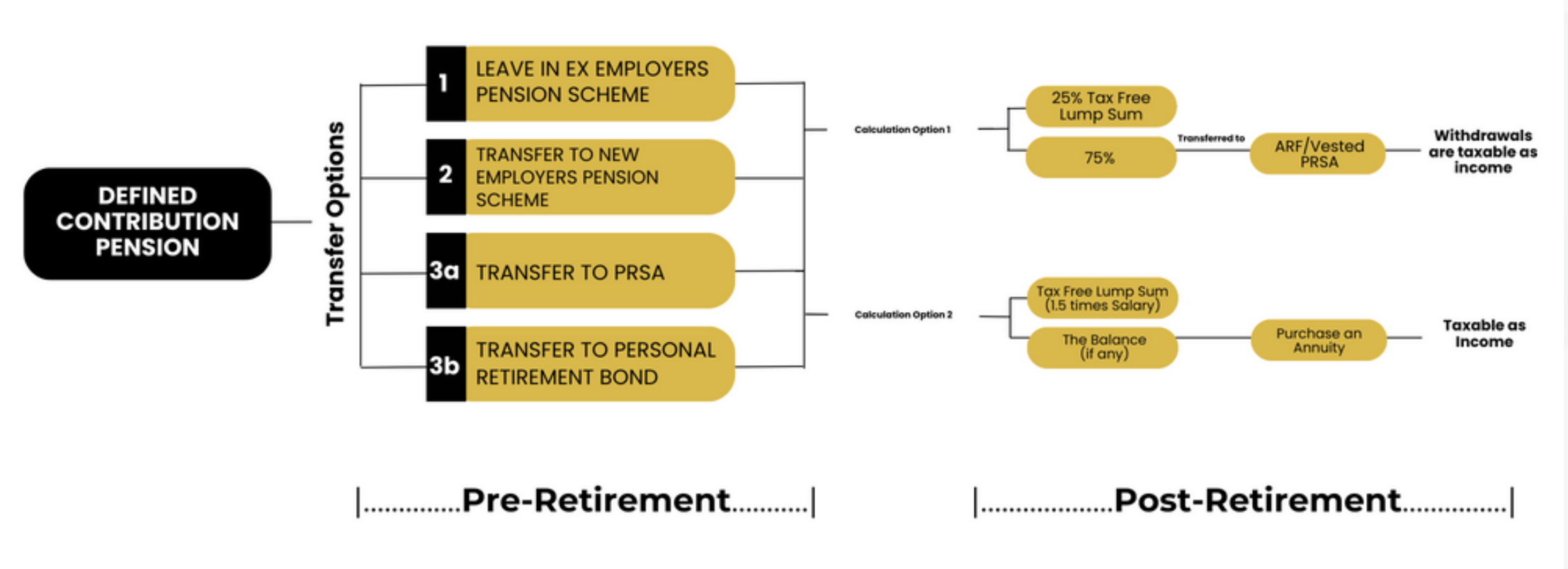

PREVIOUS DEFINED CONTRIBUTION PENSION OPTIONS

Background on DC pensions

Defined Contribution pensions are the most common type of pension in Ireland presently. Contributions are made by both employer and employee into these pensions. These aggregated contributions are added with any compounded investment

returns (positive or negative) to make up the total pension fund due to the

an employee at retirement.

On retirement, the pension benefits can be calculated and subsequently received by the pension holder in one of 2 methods;

- First option

- 25% of the total pension fund will be received as a tax-free lump sum and

- The remaining balance (75%) can be accessed either;

- Taken as taxable cash (rarely advisable)

- Transferred into an Approved Retirement Fund/Vested PRSA. Withdrawals from an ARF/Vested PRSA are taxed as income (liable for income tax, PRSI and USC).

- Second option;

- Receive a tax-free lump sum of 1.5 times the final salary with the remaining balance used to purchase an Annuity (annual pension income). The annuity income is taxed as income and liable to income tax, PRSI and USC.

The option chosen to calculate the pension benefits receivable will be directly correlated to which option gives the pension holder the most tax efficient pension benefits.

Leaving a pensionable job prior to NRA

If an employee leaves their job before their normal retirement age, they will be offered the following options in relation to their pension;

OPTION 1:

Leave their pension invested in their previous employer’s scheme and retire it under their pension scheme rules

-

- Access– limited to the normal retirement age of the scheme (usually 65).

- How are the pension benefits received and taxed?the most tax efficient of the following options

- 25% as tax free lump sum with the remaining balance invested in an ARF/Vested PRSA or

- 5 times salary as a tax-free lump sum with the balance used to purchase an annuity (annual pension income).

Both the withdrawals from the ARF/Vested and the annuity income are taxed as income and liable for income tax, PRSI and USC.

-

- Tax implications on Death – Pre Retirement– In the event of death prior to Normal retirement age (NRA), the full fund value is left to the surviving spouse. However, this benefit is capped at 4 times final salary. If widowed/divorced/single – the pension fund is left to next of kin (children) as and taxed as inheritance. No tax is paid if the lifetime limit of €335000 gift/inheritance threshold is not exceeded. Please see figure 1.2 for inheritance tax table thresholds/limits.

- Tax implications on Death – Post Retirement – If the pension has been retired and a tax-free lump sum received by the pension holder prior to death, then the remaining funds will usually have been transferred into an ARF/Vested PRSA. These benefits are then passed onto the surviving spouse tax free. However, withdrawals from the ARF/Vested PRSA are taxable as income. If widowed/divorced/single, the remaining funds within the ARF/Vested PRSA are passed onto next of Kin (usually children). Children under 21 are taxed under normal inheritance tax rules but may pay no tax if their lifetime limit for gift/inheritance limits/thresholds of €335000 are not exceeded. (see table below). Children over 21 are not taxed as inheritance but instead pay a compulsory standard tax rate of 30% on funds due from ARF/Vested PRSA.

OPTION 2:

Transfer their pension to their new occupational scheme with their new employer.

-

- Access– limited to the normal retirement age of the scheme (usually 65).

- How are the pension benefits received and taxed? the most tax-efficient of the following options;

- 25% as a tax-free lump sum with the remaining balance invested in an ARF/Vested PRSA or

- 5 times salary as a tax-free lump sum with the balance used to purchase an annuity (annual pension income).

Both the withdrawals from the ARF/Vested and the annuity income are taxed as income and liable for income tax, PRSI and USC.

-

- Tax implications on Death – Pre Retirement– In the event of death prior to Normal retirement age (NRA), the full fund value is left to the surviving spouse. However, this benefit cannot exceed 4 times the final salary. If widowed/divorced/single – the pension fund is left to the next of kin (children) as and taxed as an inheritance. No tax is paid if the lifetime limit of €335000 gift/inheritance threshold is not exceeded. Please see figure 1.2 for inheritance tax table thresholds/limits.

- Tax implications on Death – Post Retirement – If the pension has been retired and a tax-free lump sum received by the pension holder prior to death, then the remaining funds will usually have been transferred into an ARF/Vested PRSA. These benefits are then passed onto the surviving spouse tax-free. However, withdrawals from the ARF/Vested PRSA are taxable as income. If widowed/divorced/single, the remaining funds within the ARF/Vested PRSA are passed onto next of Kin (usually children). Children under 21 are taxed under normal inheritance tax rules but may pay no tax if their lifetime limit for gift/inheritance limits/thresholds of €335000 are not exceeded. (see table below). Children over 21 are not taxed as inheritance but instead pay a compulsory standard tax rate of 30% on funds due from ARF/Vested PRSA.

OPTION 3:

Transfer the full Pension Value to a Personal Retirement Bond (PRB) or PRSA with one of the main pension providers in Ireland.

-

- Access– access to the PRB or a PRSA can be gained from age 50 onward. This is a HUGE benefit when compared to the other options.

- How are the pension benefits received and taxed? the most tax efficient of the following options;

- 25% as tax free lump sum with the remaining balance invested in an ARF/Vested PRSA or

- 5 times salary as a tax-free lump sum with the balance used to purchase an annuity (annual pension income).

Both the withdrawals from the ARF/Vested and the annuity income are taxed as income and liable for income tax, PRSI and USC.

-

- Tax implications on Death – Pre Retirement– In the event of death prior to Normal retirement age (NRA), the full fund value is left to the surviving spouse. If widowed/divorced/single – the pension fund is left to next of kin (children) as and taxed as inheritance. No tax is paid if the lifetime limit of €335000 gift/inheritance threshold is not exceeded. Please see figure 1.2 for inheritance tax table thresholds/limits.

- Tax implications on Death – Post Retirement – If the pension has been retired and a tax-free lump sum received by the pension holder prior to death, then the remaining funds will usually have been transferred into an ARF/Vested PRSA. These benefits are then passed onto the surviving spouse tax free. However withdrawals from the ARF/Vested PRSA are taxable as income. If widowed/divorced/single, the remaining funds within the ARF/Vested PRSA are passed onto next of Kin (usually children). Children under 21 are taxed under normal inheritance tax rules but may pay no tax if their lifetime limit for gift/inheritance limits/thresholds of €335000 are not exceeded. (see table below). Children over 21 are not taxed as inheritance but instead pay a compulsory standard tax rate of 30% on funds due from ARF/Vested PRSA.

Points to consider before choosing which option to take

In general, it almost always makes sense to choose option 3 – transferring into a PRB or PRSA.

Why?

-

- Early access from age 50

- More comprehensive death benefit

- Mitigate and risks associated with your ex-employer

- mismanaging your pension or

- charging excessive annual fees and charges

- getting into financial difficulty/ceasing trading/moving its operations outside Ireland

- Full control over where your pension fund is invested

If you would like any assistance in making your decision you can contact and book a free consultation with one of our Highly qualified and experienced Pension consultants. We have vast experience in all of the following areas;

-

- Requesting transfer values from previous employers on your behalf

- Tracing and locating old pensions

- Assessing and advising on the most tax-efficient option available to you in relation tax-free lump sums receivables, taxes payable on drawdown and death benefit analysis.

- Processing all of the paperwork required if taking the transfer value

- Assist in choosing the best pension provider for any pension transfer

- Choosing the best investment strategy that suits your requirements