Saving for Education in Ireland: A Practical Guide for Parents

As any Irish parent knows, the cost of putting a child through college is not getting any cheaper. Between tuition fees, accommodation, books, and living

🔸 Start investing with as little as €5,000.

🔸 Your money is immediately exposed to market growth.

🔸 Potential for higher long term returns compared to regular savings.

🔸 Ideal for investing a retirement lump sum or inheritance.

🔸 Option to generate monthly income from your investment.

🔸 Choose from low, medium, or high-risk fund options.

🔸 Access capital-protected investment plans for peace of mind.

🔸 Simple, one-time investment with less ongoing effort.

🔸 Professionally managed by trusted Irish providers.

🔸 Tailored to your risk level and financial goals.

🔸 Helps maximise returns while planning for tax efficiency.

🔸 Suitable for those looking for the best lump sum investment plan in Ireland.

Lump sum investing is a powerful strategy where you invest a single

large amount, rather than smaller, regular contributions over time. Think

of it as planting a mature tree rather than a seedling—your growth

potential begins immediately.

With a minimum starting amount of just €5,000, your capital can be invested across a range of professionally managed funds, tailored to your risk appetite and financial goals.

Choose from expertly selected funds:

Start capturing growth from day one.

Historically, lump-sum investors may outperform regular savers over the long term.

A one-time commitment. Less hassle. More freedom.

Aiming for high growth

For peace of mind

With rental or capital appreciation potential

Balanced to match your risk profile

To invest in a lump sum product, you generally need to meet the

following:

Here’s what you typically need to get started:

Worried about risk? Ireland offers capital-protected investment options such as:

These are ideal for conservative investors who value security and

predictability.

Ideal for cautious investors. Includes bonds, deposits, and capitalprotected plans.

Balanced mutual funds, real estate, and corporate bonds. Designed for steady growth with manageable fluctuations

Equities, emerging markets, and high-growth funds. Best suited for those who accept more volatility in pursuit of higher rewards.

Note: The funds you choose—and when you invest—will significantly impact your long-term growth. Always seek professional advice.

Diversify: Spread your money across multiple asset types to reduce risk.

Review Regularly: Even one-time investments deserve check-ins.

Plan for Taxes: Understand Capital Gains Tax (CGT) and DIRT implications to maximise your net returns.

Stay Informed: Let your advisor guide you as market conditions shift.

Inflation is the increase in the price of a typical basket of goods andservices. It reflects the general cost of living in a country.

Over time, a typical €100 will not buy the same amount of goods or services that it does today. If your lump sum savings are not invested and generating at least a modest average net 2% return, inflation is slowly eating away at their real value.

Think about the rising cost of everyday essentials — from housing and

utilities to food, transport, and healthcare. By the time you need your

money in the future, it may hold less purchasing power if it has simply

been left in a low-interest bank account.

By investing your lump sum, you put a strategy in place to protect and

potentially grow the purchasing power of your hard-earned savings.

The hidden danger? Not investing and letting inflation erode your

money over time — a risk many savers overlook until it’s too late.

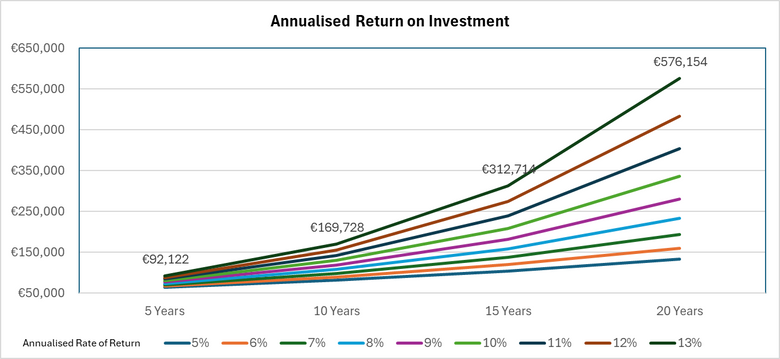

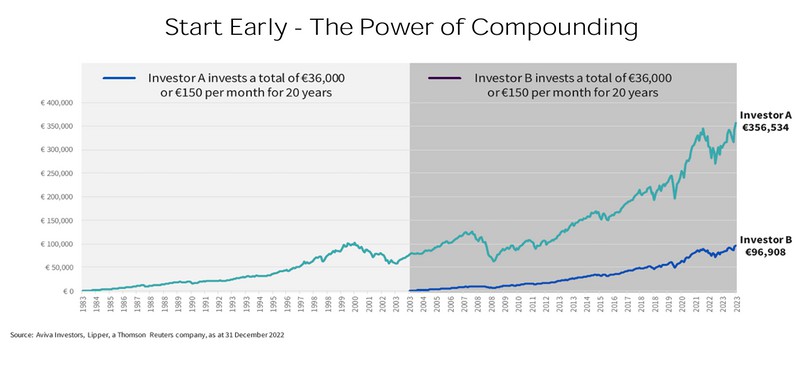

Although saving money in any form is always recommended, investing a lump sum over the long term has been proven to be an even more financially prudent decision.

When you place your lump sum into an investment plan rather than leaving it in a low-interest savings account, you give it the chance to grow through compounding. Over time, not only do your original savings grow, but any returns generated are reinvested and begin to generate returns themselves.

This compounding creates a snowball effect, where the value of your lump sum can grow significantly larger over the years compared to simply keeping it in a deposit account.

For example, investing a putting your money to workover 15–20 years with consistent positive annual returns can result in a much larger future value than leaving it untouched in a bank account that barely keeps pace with inflation.

By choosing to invest, you are not just holding money — you are putting your money to work and giving it the potential to grow into something far more powerful for your future.

|

Initial Contribution

|

Term (Years)

|

Annualised Average net % Returns

|

Total Gross Savings Plan Value After 15 Years

|

Value of Saving in Bank a/c if you don’t invest

|

Variance

|

€50,000

|

15

|

5%

|

€103,946

|

€50,000

|

€53,946

|

|---|---|---|---|---|---|

|

€50,000

|

15

|

6%

|

€119,828

|

€50,000

|

€69,828

|

|

€50,000

|

15

|

7%

|

€137,952

|

€50,000

|

€87,952

|

|

€50,000

|

15

|

8%

|

€158,608

|

€50,000

|

€108,608

|

|

€50,000

|

15

|

9%

|

€182,124

|

€50,000

|

€132,124

|

|

€50,000

|

15

|

10%

|

€208,862

|

€50,000

|

€158,862

|

|

€50,000

|

15

|

11%

|

€239,229

|

€50,000

|

€189,229

|

|

€50,000

|

15

|

12%

|

€273,678

|

€50,000

|

€223,678

|

|

€50,000

|

15

|

13%

|

€312,714

|

€50,000

|

€262,714

|

*Figures are for illustration purposes only and do not represent guaranteed returns.

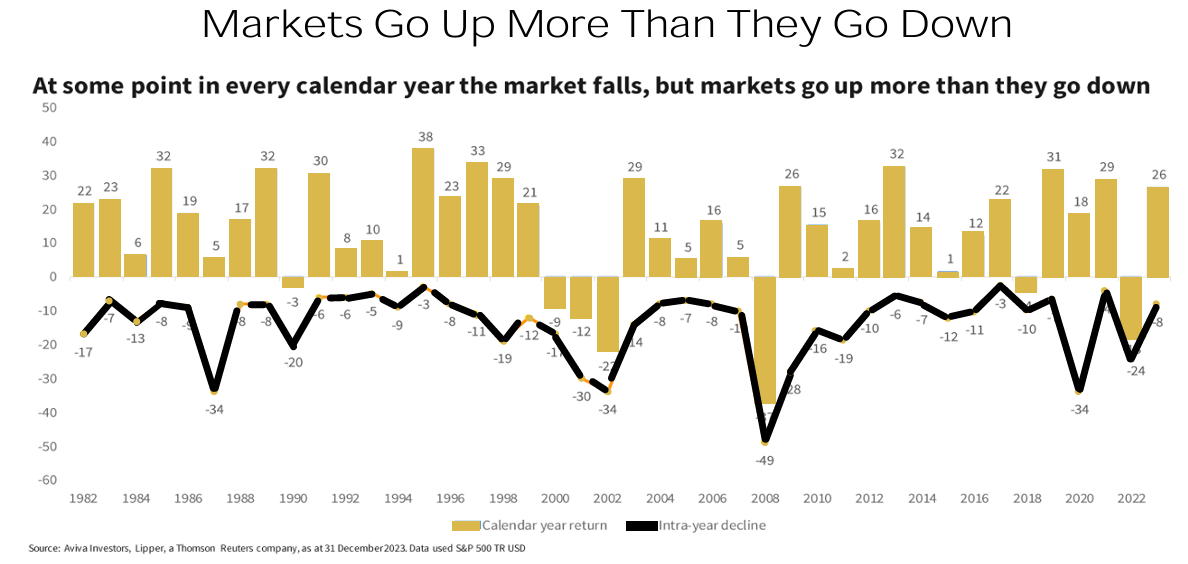

Below is a chart of the actual returns of the S&P 500 since 1950. The S&P 500 is an index that tracks the top 500 companies in thenUnited States. Although there have been good and bad years, the average return from 1950 to 2025 is 10.83%

*Please note that actual return can go up and down, and past performance is not a true indicator of future investment performance*

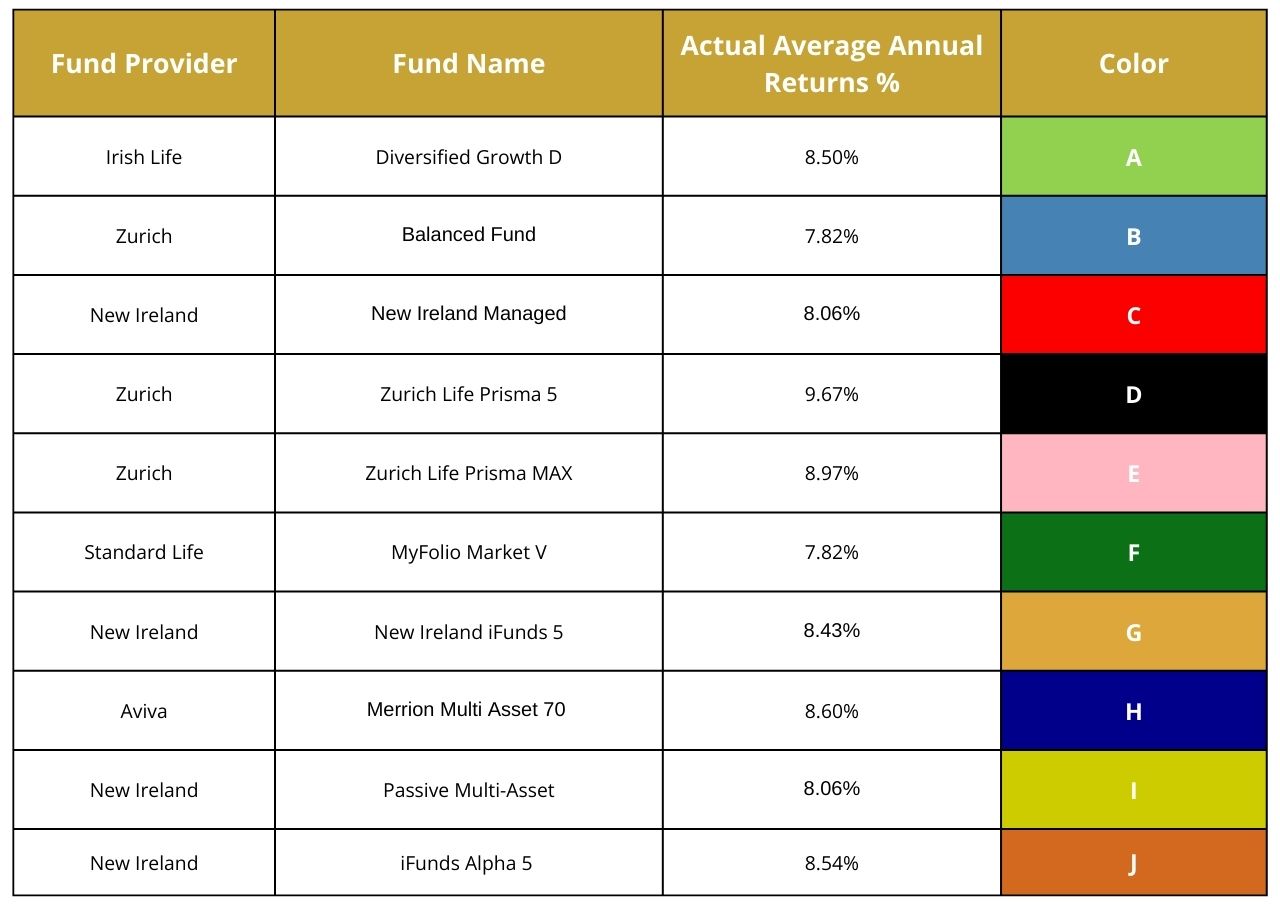

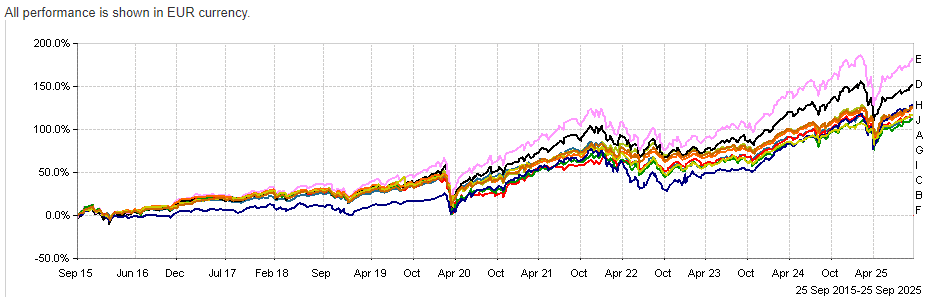

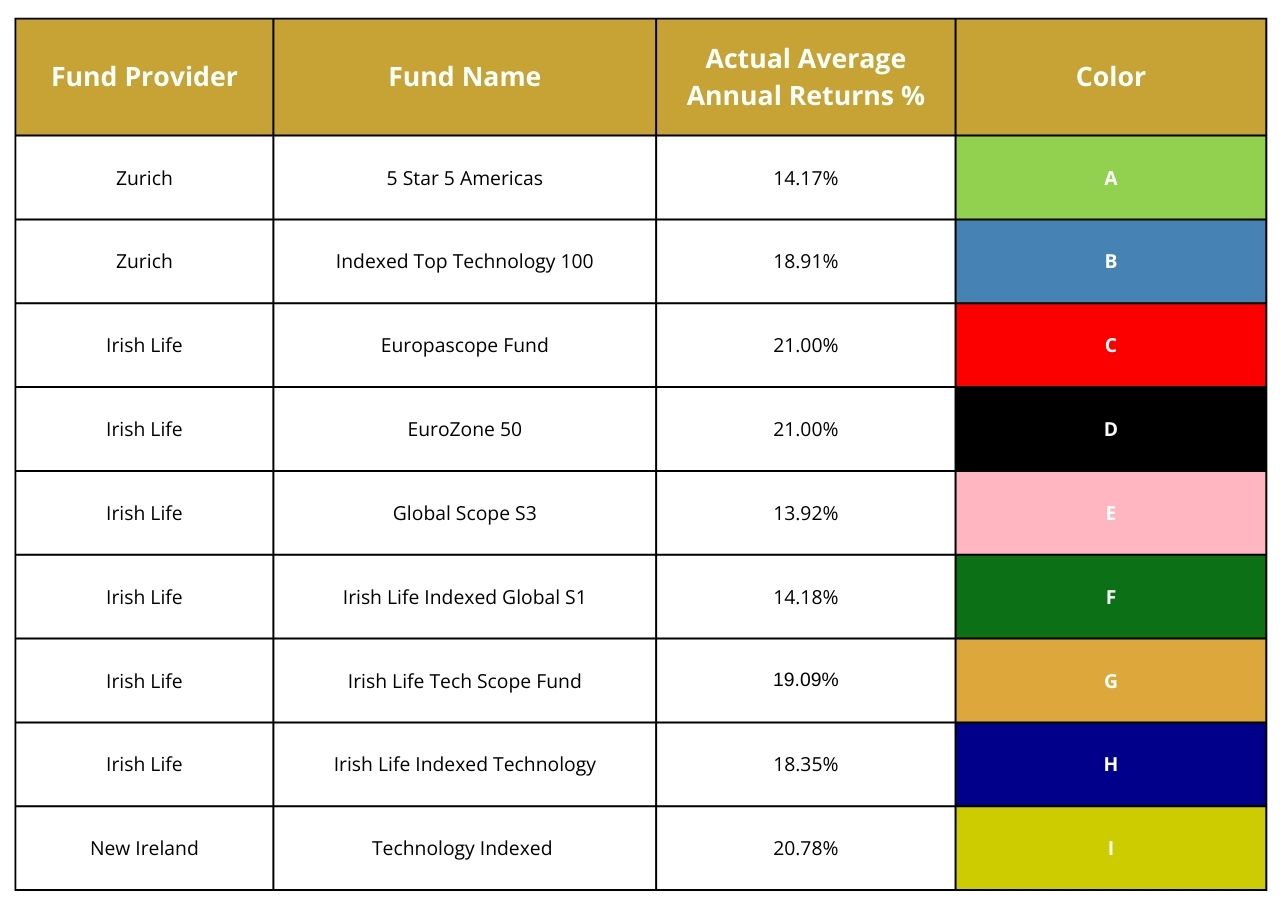

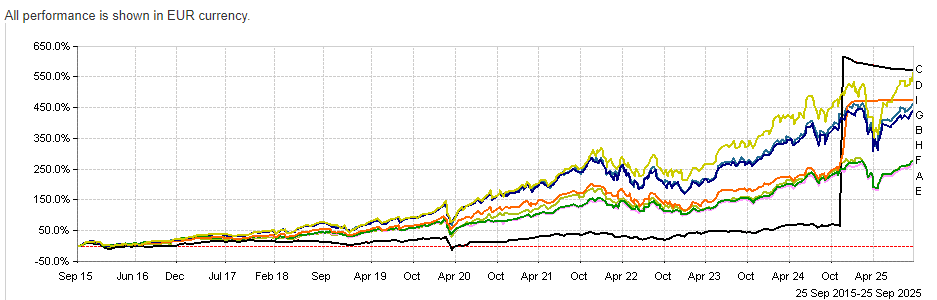

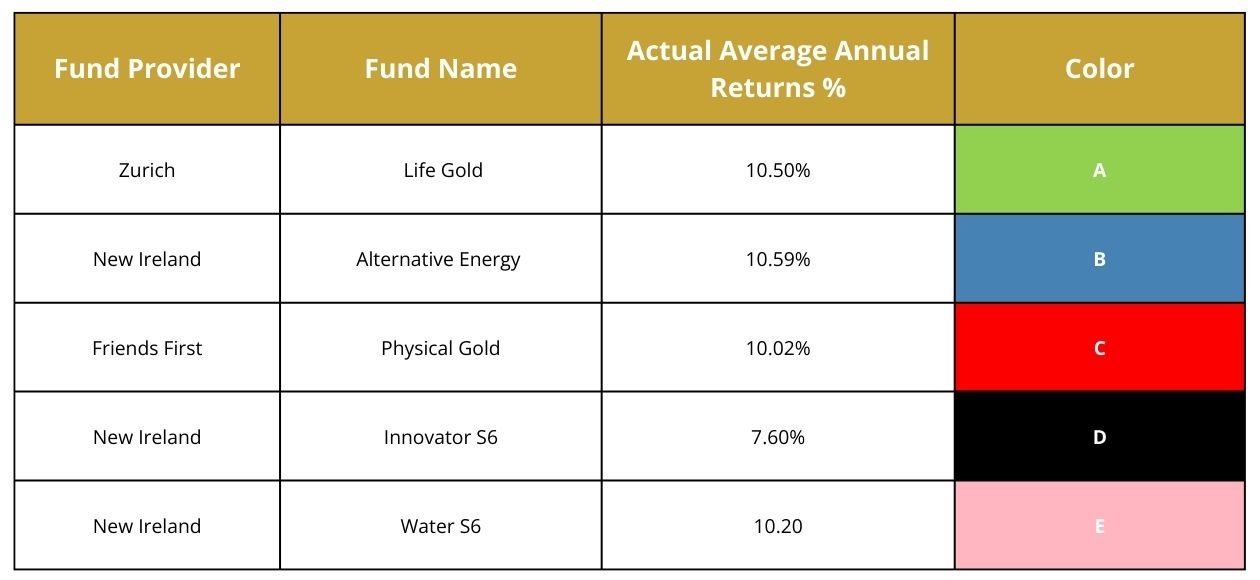

Before starting a Regular Saver Investment Plan, it’s essential to compare all available providers in Ireland so you can make the most informed decision and choose the one that best suits your needs.

As a fully Central Bank-regulated multi-agency financial brokerage, we

only recommend providers who are also fully Central Bank of Irelandregulated — giving you extra protection and peace of mind.

Regular saver investment plans in Ireland are typically provided through Life Assurance Companies. The most common and trusted providers include:

To help you make the best choice, we compare all providers in the following key areas:

Once you’ve chosen your provider, we’ll guide you through every step — from completing paperwork to activating your plan — so you can start saving and investing with confidence.

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Ans: Yes, lump sum investing can be a smart strategy—especially for longterm investors. By investing your full amount at once into a diversified portfolio, your capital has the opportunity to benefit from market growth immediately. Historically, this approach often outperforms dripfeeding money over time. It's particularly effective if you're looking for the best investment for a retirement lump sum or planning to invest a pension lump sum.

Ans: Like any investment, a lump sum investment carries some level of risk. Because you're investing a larger amount at once, your portfolio may face short-term market fluctuations. However, for those with a long term outlook and a comfortable risk tolerance, it can lead to higher returns. If you’re not ready for market ups and downs, consider alternatives like regular monthly investments or lump sum investments in mutual fund options with lower volatility. significantly increases borrowing power.

Ans: Wondering whether it’s better to invest a lump sum or in monthly instalments? Over short periods, the difference might be minimal. But over time, investing early often results in greater compounding benefits. That’s why many experts recommend lump sum investment plans if your goal is to maximise long-term returns, especially with retirement lump sum investment options.

Ans: The key risk with lump sum investing is exposure to market volatility right from the start. If markets drop soon after you invest, your portfolio could temporarily lose value. But over the long term, markets tend to recover, and early entry gives your capital more time to grow. That’s why diversifying and selecting the right funds—such as those in capital protected lump sum pension plans—can help reduce risk.

Ans: While keeping your money in a regular bank account feels safe, it usually earns very little interest. If you want your money to grow, consider lumpsum investment options like:

Ans: Wondering whether it’s better to invest a lump sum or in monthly instalments? Over short periods, the difference might be minimal. But over time, investing early often results in greater compounding benefits. That’s why many experts recommend lump sum investment plans if your goal is to maximise long-term returns, especially with retirement lump sum investment options.

Ans: The key risk with lump sum investing is exposure to market volatility right from the start. If markets drop soon after you invest, your portfolio could temporarily lose value. But over the long term, markets tend to recover, and early entry gives your capital more time to grow. That’s why diversifying and selecting the right funds—such as those in capitalprotected lump sum pension plans—can help reduce risk.

Ans: While keeping your money in a regular bank account feels safe, it usually earns very little interest. If you want your money to grow, consider lumpsum investment options like:

Choosing the best interest rates for lump sum investments depends on your time horizon, risk tolerance, and whether you’ll need regular income or long-term growth.

As any Irish parent knows, the cost of putting a child through college is not getting any cheaper. Between tuition fees, accommodation, books, and living

Introduction: Why a Regular Investment Plan in Ireland Matters in 2026 If you’ve ever wondered how to turn your pension into a powerful wealth-building tool,

The cost of sending a child to college in Ireland is climbing every year — and in 2026, it’s a topic that’s firmly on the

Whether you’re investing an inheritance, a bonus, or savings you’ve worked hard for, this is your moment.

Money Maximising Advisors Limited is regulated by the Central Bank of Ireland – C154250