Are you sitting on a hidden treasure in your home? Many homeowners are surprised to learn that their property holds more value than they realize. With rising living costs and unexpected expenses, tapping into that equity can provide the financial relief you need. If you’ve got a mortgage, though, you’re probably wondering: Can I still access this potential cash flow?

Equity release options might be just what you’re looking for. They allow you to unlock funds from your property without having to sell it or move out. But the prospect of combining equity release with an existing mortgage raises questions about feasibility and benefits.

Let’s dive deeper into the world of equity release on a mortgage and explore how it could work for you. Whether it’s funding retirement dreams or consolidating debt, there’s plenty to uncover!

Understanding Equity Release

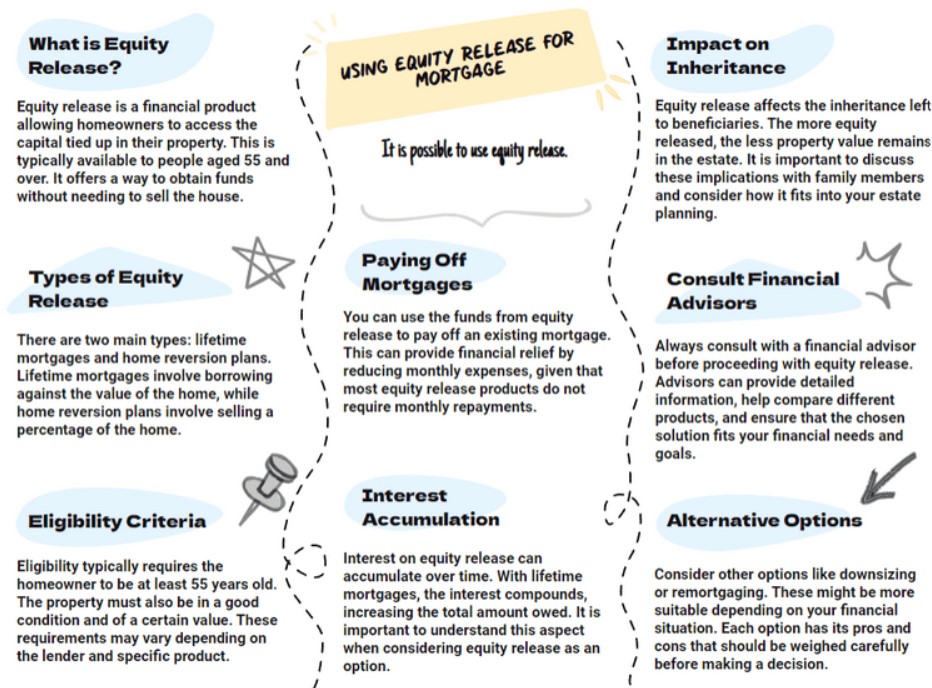

Equity release is a financial solution designed for homeowners aged 55 and over. It allows individuals to access cash tied up in their property without needing to sell or move out. This can be particularly appealing for retirees looking to enhance their quality of life.

When you enter an equity release plan, you essentially borrow against the value of your home. This means that as property values increase over time, so does your available equity.

There are two primary types: lifetime mortgages and home reversion plans. Lifetime mortgages let you retain ownership while borrowing against your home’s value. Home reversion involves selling a portion of your house for immediate cash but retaining the right to live there rent-free until you pass away or move into care.

Understanding these options is essential before making any decisions about accessing funds from your property.

What is the equity release on a mortgage?

Equity release on a mortgage allows homeowners to tap into the value of their property while continuing to live there. Essentially, it converts part of your home’s equity into cash without requiring you to sell.

When you have a mortgage, this process can be particularly beneficial. It provides an opportunity for those who may feel financially constrained but own significant assets in their homes.

The amount released typically depends on your age and the property’s market value. This means that older homeowners often qualify for more funds due to lower life expectancy calculations used by providers.

With equity release plans, borrowers are not required to make monthly repayments. Instead, the loan is repaid when you move out or pass away, making it appealing for many retirees seeking extra income during retirement years.

📩 Enquire Now – to unlock the potential of your property today with Money Maximising Advisors.

Types of Equity Release Plans

Equity release plans come in various forms, each catering to different needs and situations. The two primary types are lifetime mortgages and home reversion schemes.

Lifetime mortgages allow homeowners to borrow against their property while retaining ownership. You can choose to pay off the interest or let it roll up over time, which is a flexible option for many.

Home reversion schemes involve selling a portion of your property in exchange for cash. You continue living there rent-free until you pass away or move into care. This plan typically suits those who don’t mind giving up partial ownership.

Both options have unique features and implications that can affect your financial future significantly. It’s crucial to explore these variations thoroughly before making a decision on equity release on mortgage solutions tailored to your needs.

Can You Get an Equity Release with a Mortgage?

Many homeowners wonder if they can access equity release while still having a mortgage. The good news is that it’s possible, but there are some conditions to consider.

Equity release on a mortgage allows you to tap into the value of your home without needing to sell it. However, lenders often assess your existing mortgage balance and terms before approving an additional equity release plan.

It’s crucial to evaluate how much equity you have built up. If your property has increased in value, you may be eligible for more funds than anticipated.

Additionally, some plans require paying off part or all of the existing mortgage first. This might involve remortgaging or using savings.

Consulting with Money Maximising Advisors can provide clarity on options tailored to your financial situation and goals. They help ensure you’re making informed decisions as you explore this financial avenue.

📅 Book Now – Schedule your consultation with our expert advisors today.

Is It Better to Remortgage or Release Equity?

Deciding between remortgaging and releasing equity can be a complex choice. Remortgaging usually involves switching to a new mortgage deal that could offer better rates or terms. This option may help reduce monthly payments and save on interest over time.

On the other hand, equity release allows homeowners to tap into their property’s value without having to move. This approach can provide immediate cash flow for expenses like home improvements or retirement plans.

However, it’s crucial to consider long-term implications. While remortgaging might lower your current financial burden, releasing equity increases your overall debt against the property. Your estate’s value will decrease when you pass away or move into care.

The decision should align with your financial goals and personal circumstances. Seeking advice from Money Maximising Advisors could clarify which path suits you best while considering potential benefits and risks involved in either option.

Advantages and Disadvantages of Combining an Equity Release with a Mortgage

Combining equity release with an existing mortgage can be a strategic move, but it comes with its own set of pros and cons.

One major advantage is that you can access additional funds while still benefiting from any increase in your property’s value. This could provide crucial financial support for retirement or large expenses.

On the flip side, adding an equity release product on top of a mortgage may lead to higher overall debt levels. It’s important to consider how this will affect long-term financial health.

Additionally, you might face restrictions when trying to switch lenders later on. Some providers have specific terms regarding property ownership after releasing equity.

Combining these options requires careful planning. Consulting Money Maximising Advisors can help navigate the complexities and ensure your choices align with future goals. Each situation is unique; weighing these factors carefully is essential for making informed decisions.

Factors to Consider Before Deciding on Equity Release

Before diving into equity release, consider your long-term plans. Are you planning to stay in your home for years? The implications of releasing equity could affect your estate and inheritance.

- Think about the costs involved as well. Fees can accumulate quickly with some plans, impacting how much money you actually receive.

- Your current mortgage situation is also crucial. Some lenders may not allow a second charge on the property if there’s an existing mortgage. Understanding these terms can help prevent future complications.

- Don’t forget to evaluate your financial status. How will this decision impact your monthly cash flow?

- Consult Money Maximising Advisors to explore tailored options that suit your unique needs. They can provide insights tailored specifically for you, helping navigate through available choices seamlessly.

Conclusion

Equity release on a mortgage can be a viable option for many homeowners looking to free up cash from their property. Understanding the nuances of equity release is essential, especially if you’re already managing an existing mortgage.

Choosing between remortgaging or releasing equity depends heavily on your individual financial goals. While remortgaging may offer lower interest rates, releasing equity allows access to funds without needing monthly repayments—an attractive option for many retirees or those in need of immediate cash.

Combining an equity release plan with a mortgage has its own set of advantages and disadvantages. It could provide significant liquidity but also add complexity to your finances that may not suit everyone’s needs.

Deciding whether to proceed requires thorough research and possibly consulting Money Maximising Advisors who can guide you through various options available based on your unique circumstances. With all these elements at play, it’s important to ensure you make informed choices tailored specifically for you.

Don’t wait, claim your financial freedom now! Contact Money Maximising Advisors.