Maximising Your Wealth in 2026: A Complete Guide to Ireland’s Small Gift Exemption

Gifting money to loved ones is a thoughtful gesture, but in Ireland, navigating the tax implications can feel like walking through a maze. Whether you’re

Tax-efficient savings plans set up to transfer cash assets from a parent/grandparent/ aunt/uncle to children/grandchildren /nieces/nephews without triggering any gift or inheritance tax liability, either now or in the future.

🔸 These savings plans enable each parent, grandparent, uncle, or aunt to transfer the annual gift exemption of up to €3,000 to a child or beneficiary without triggering any gift or inheritance tax liability (CAT) either now or in the future.

🔸 The gift does not affect or reduce the beneficiary's lifetime gift or inheritance tax exemption limits.

🔸 Contributions to the savings plan can be made monthly or annually to each policy.

🔸 Contributions can be made to this plan for as long as the payer (parent/grandparent/aunt/uncle) wishes.

🔸 Contributions can be paused/ceased at any time; however, all contributions are owned by the child/beneficiary and can’t be reversed.

🔸 The contributions to the savings plan are invested and can benefit from compounded returns over time.

🔸 All future investment returns are also exempt from any CAT liability.

🔸 They are available to under 18 and over 18-year-olds - however their entitlements are slightly different.

There are 2 types or variations of these savings plans, each with its unique set of terms and setup requirements.

These types of plans are typically used and most suitable for the following scenarios:

Most insurance providers in Ireland provide these plans, namely Irish Life, Zurich, Aviva, New Ireland, and Standard Life. It is always recommended to compare each provider on the following:

It is important to speak to your Financial Advisor before choosing any provider.

Most insurance providers in Ireland provide these plans, namely Irish Life, Zurich, Aviva, New Ireland, and Standard Life. It is always recommended to compare each provider on the following:

Fees & charges

Allocation rate

Set up fees

Annual management charges

Customer service reputation of the provider

Investment choice and performance of providers’ funds

It is important to speak to your Financial Advisor before choosing any provider.

To help explain these types of savings plans and their benefits, below are 2 case scenarios of when these are typically used.

Tom and Louise have recently become grandparents of Oisin and have decided to set up a children’s small gift exemption savings plan for him.

Under revenue rules, they can both gift him €3,000 per year and still avoid any capital acquisition tax liabilities for Oisin, either now or in the future. This gift doesn’t affect or reduce his €40,000 lifetime Capital Acquisition Tax exemption threshold limit.

They set up this tax-efficient savings plan and started contributing €500 per month from one of their joint bank accounts.

Tom, the trustee of the policy, was chosen to manage the investments until Oisin is over 18. Oisin can take over the management of this savings plan at this stage. However, until then, he cannot access or withdraw any of these savings.

Tom decides to invest the savings plan funds in a Balanced multi-asset fund with a main Insurance Company that provides these plans.

This fund is classed as medium risk and has a 20-year track record of generating a net return of 7% per annum

If Tom & Loise continue contributing €500 per month and invest in the

balanced multi-asset fund until Oisin’s 18th Birthday, generating a net

average annual return of 7%, the compounded value of Oisin’s fund on his 18th birthday will be close to €160,000.

All these funds will be exempt from the Capital Acquisition tax, and Oisin can use the savings pot to pay for his college education or indeed help him with a deposit for his first property purchase when the time comes.

John is a Business owner and has a Net worth from all assets of circa €3 million. After chatting to his financial advisor, he has been made aware that on death, his 3 children will be faced with a Capital Acquisition tax bill of over €600,000. To pay for this tax bill, they may be forced to sell the family business or the family home.

John has some cash investments and has decided, as part of his estate planning strategy, to gift this cash to his 3 sons and his 10 grandchildren while he is still alive.

John can transfer €39,000 annually to his family and not trigger any Capital Acquisition tax liability or indeed reduce the CAT lifetime limit exemption of €400,000 for each son and €40,000 for grandchildren.Over 10 years, John will have gifted €390,000 to his family tax-free. If he invested these funds, all compounded returns are also exempt from CAT.

To find out more about a Small Gift Exemption Savings plan, enquire now.

Ans: Estate planning is a process that involves preparing for the future, particularly concerning the management and distribution of assets after a person’s death or in the event of their incapacity. It encompasses various aspects, including creating wills, trusts, powers of attorney, and living wills to ensure assets are distributed as desired and to minimise tax liabilities.

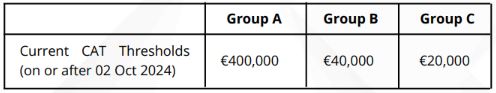

Ans: CAT is a tax on gifts and inheritances. Your client’s beneficiary can receive gifts and inheritances up to a set value over their lifetime before paying CAT. Gifts and inheritances received below this threshold over the beneficiary’s lifetime are not subject to CAT.

Generally, Group A includes children of the disponer. Group B includes other relatives of the disponer, such as grandparents. Group C includes everyone else. For more details, see CAT groups and group thresholds (revenue.ie).

Ans: Under the Small Gift Exemption, Exempt from gift tax. This means an individual can receive multiple €3,000 giftys from different people within the same year, all exempt from Capital Acquisitions Tax (CAT).

Ans: Exit tax is payable on all returns made from Small Gift Exemption Savings plans in Ireland. The current rate is 40%. If, by year 8, the savings policy has not been encashed, the exit tax payable on the returns made is automatically deducted from these savings plans by the relevant insurance companies and subsequently paid over to the Revenue on your behalf.

Ans: A Bare Trust is a type of trust that allows money to be paid by a Settlor(s) to a trust fund managed by Trustees on behalf of the Beneficiaries of the trust. The Settlors and Trustees are often the Beneficiaries’ parents, grandparents, or other relatives.

There are 2 types or variations of these savings plans, each with its unique set of terms and setup requirements.

Gifting money to loved ones is a thoughtful gesture, but in Ireland, navigating the tax implications can feel like walking through a maze. Whether you’re

A comprehensive guide to Small Gift Exemption Savings Plans in Ireland, explaining their benefits, types for both under and over 18s, and how they enable

Ireland’s small gift exemption savings plans allow you to transfer money or assets to a child, grandchild, niece, nephew, or godchild without incurring any gift

Money Maximising Advisors Limited is regulated by the Central Bank of Ireland – C154250