Beginner Friendly Guide to Investing in Ireland

Are you ready to leap investing in Ireland? Whether you’re a complete novice or just looking

🔸 Potential for higher returns than bank or credit union savings.

🔸 Choose investment plans to match your risk level avoid your money being eroded by inflation by not investing it and leaving it sit in your Bank .......Credit Union.

🔸 Stop, pause, or increase contributions anytime.

🔸 Save any amount, collect at any time.

🔸 Full flexibility for withdrawals.

🔸 Wide range of plans tailored to your goals.

🔸 Personalised strategies from expert financial advisors.

🔸 Monthly investing helps smooth out market highs and lows.

Because your money deserves more than sitting idle in an account that earns little to no interest.

Whether you’re aiming for:

A Regular Saver Investment Plan can help you reach your goal faster while giving your savings the potential to grow. By investing regularly — even in small amounts — you allow your money to benefit from long term growth and investment performance, without sacrificing control or flexibility.

With a super-flexible, high-return, and low-risk Regular Saver Investment Plan, you can:

Making consistent contributions helps your money grow steadily over time. Even small amounts, invested regularly, can grow into a significant sum — and your plan remains under your control every step of the way.

Making consistent contributions helps your money grow steadily over time. Even small amounts, invested regularly, can grow into a significant sum — and your plan remains under your control every step of the way.

Inflation is the increase in the price of everyday goods and services — the rising cost of living over time.

A typical €100 today will not buy the same amount in the future. If your savings aren’t invested and earning at least a net 2% return, inflation is quietly reducing their value.

By investing your savings, you create a strategy to maintain or even enhance the purchasing power of your hard-earned money.

The danger? Not investing allows inflation to erode your savings gradually — a hidden risk that often goes unnoticed until it’s too late.

While saving in any form is wise, investing those savings over the long term can be an even more powerful financial decision.

When you invest regularly into a Regular Saver Investment Plan, you allow your contributions — and any returns they generate — to compound over time. This compounding can create a snowball effect, significantly increasing the value of your savings in the long run.

Please see below a comparison on €50,000 investment over 15 years generating gross annualised return from 5% to 13%.

Without Monthly Contributions

Initial Contribution | Term (Years) | Annualised Average net % Returns | Total Gross Savings Plan Value After 15 Years | Value of Saving in Bank a/c if you don’t invest | Variance |

€50,000 |

15 |

5% |

€103,946 |

€50,000 |

€53,946 |

|---|---|---|---|---|---|

€50,000 |

15 |

6% |

€119,828 |

€50,000 |

€69,828 |

€50,000 |

15 |

7% |

€137,952 |

€50,000 |

€87,952 |

€50,000 |

15 |

8% |

€158,608 |

€50,000 |

€108,608 |

€50,000 |

15 |

9% |

€182,124 |

€50,000 |

€132,124 |

€50,000 |

15 |

10% |

€208,862 |

€50,000 |

€158,862 |

€50,000 |

15 |

11% |

€239,229 |

€50,000 |

€189,229 |

€50,000 |

15 |

12% |

€273,678 |

€50,000 |

€223,678 |

€50,000 |

15 |

13% |

€312,714 |

€50,000 |

€262,714 |

Figures are for illustration purposes only and do not represent guaranteed returns.

Initial Contribution | Monthly Contribu tions | Term (Years) | Annualised Average net % Returns | Total Gross Savings Plan Value After 15 Years | Value of Saving in Bank a/c if you don’t invest | Variance |

€50,000 |

€500 |

15 |

5% |

€233,418 |

€140,000 |

€93,418 |

|---|---|---|---|---|---|---|

€50,000 |

€500 |

15 |

6% |

€259,484 |

€140,000 |

€119,484 |

€288,726 |

€500 |

15 |

7% |

€50,000 |

€140,000 |

€148,726 |

€50,000 |

€500 |

15 |

8% |

€321,521 |

€140,000 |

€181,521 |

€50,000 |

€500 |

15 |

9% |

€358,290 |

€140,000 |

€218,290 |

€50,000 |

€500 |

15 |

10% |

€399,497 |

€140,000 |

€259,497 |

€50,000 |

€500 |

15 |

11% |

€445,662 |

€140,000 |

€305,662 |

€50,000 |

€500 |

15 |

12% |

€50,000 |

€140,000 |

€357,357 |

€497,357 |

€500 |

15 |

13% |

€555,218 |

€140,000 |

€415,218 |

Figures are for illustration purposes only and do not represent guaranteed returns.

Below is a chart of the actual returns of the S&P 500 since 1950. The S&P 500 is an index that tracks the top 500 companies in the United States. Although there have been good and bad years, the average return from 1950 to 2025 is 10.83%

Before starting a Regular Saver Investment Plan, it’s essential to compare all available providers in Ireland so you can make the most informed decision and choose the one that best suits your needs.

As a fully Central Bank-regulated multi-agency financial brokerage, we

only recommend providers who are also fully Central Bank of Irelandregulated — giving you extra protection and peace of mind.

Regular saver investment plans in Ireland are typically provided through Life Assurance Companies.

The most common and trusted providers include:

To help you make the best choice, we compare all providers in the following key areas:

Once you’ve chosen your provider, we’ll guide you through every step — from completing paperwork to activating your plan — so you can start saving and investing with confidence.

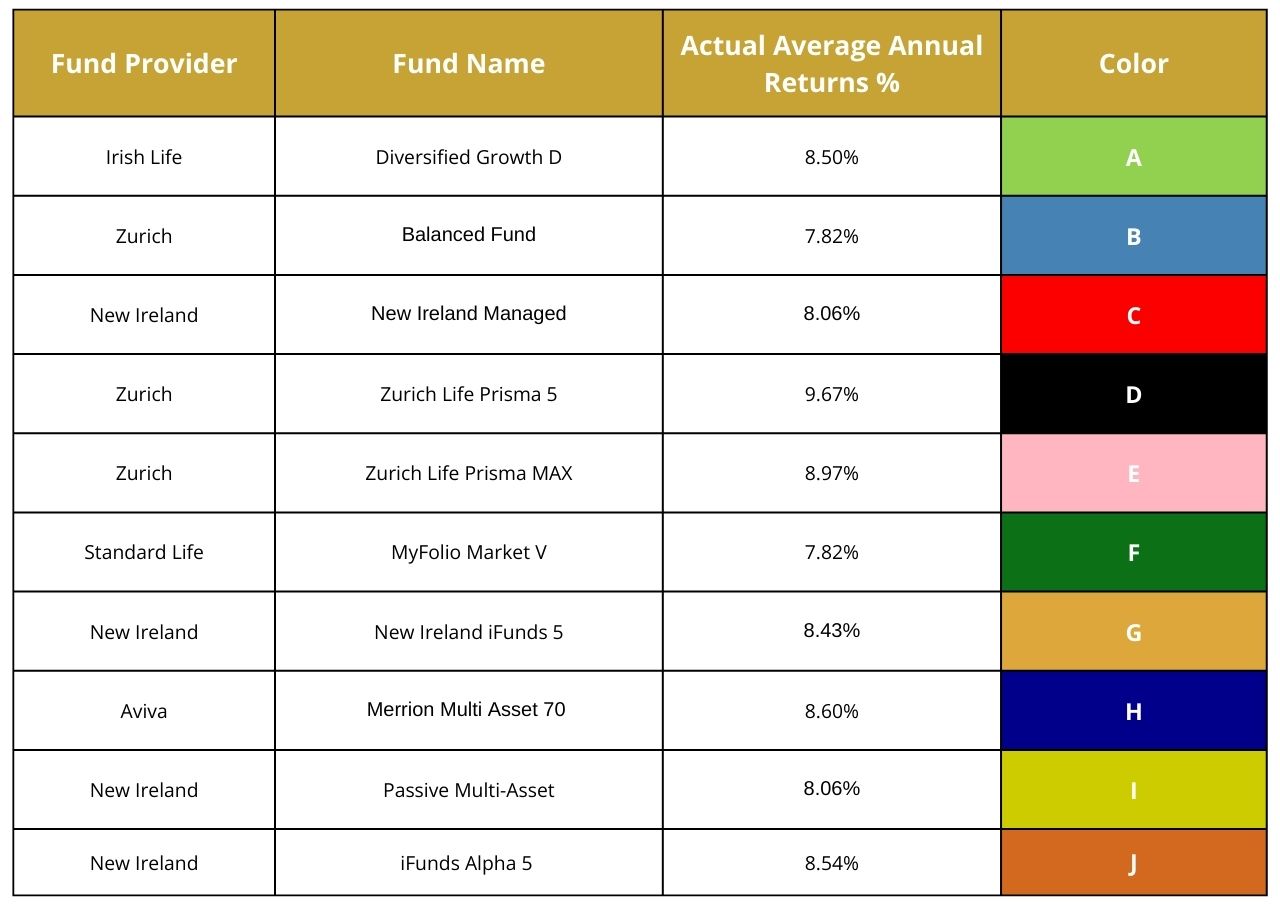

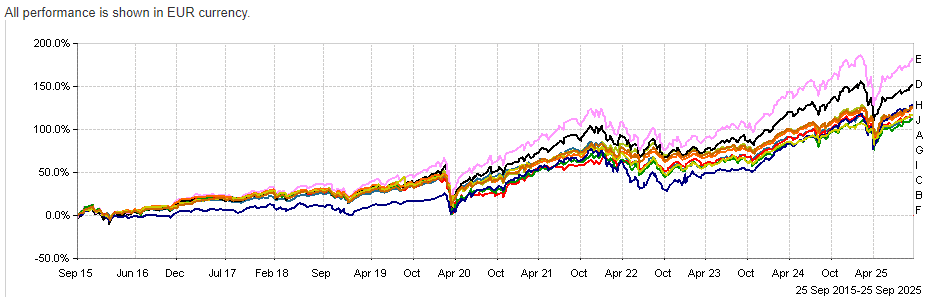

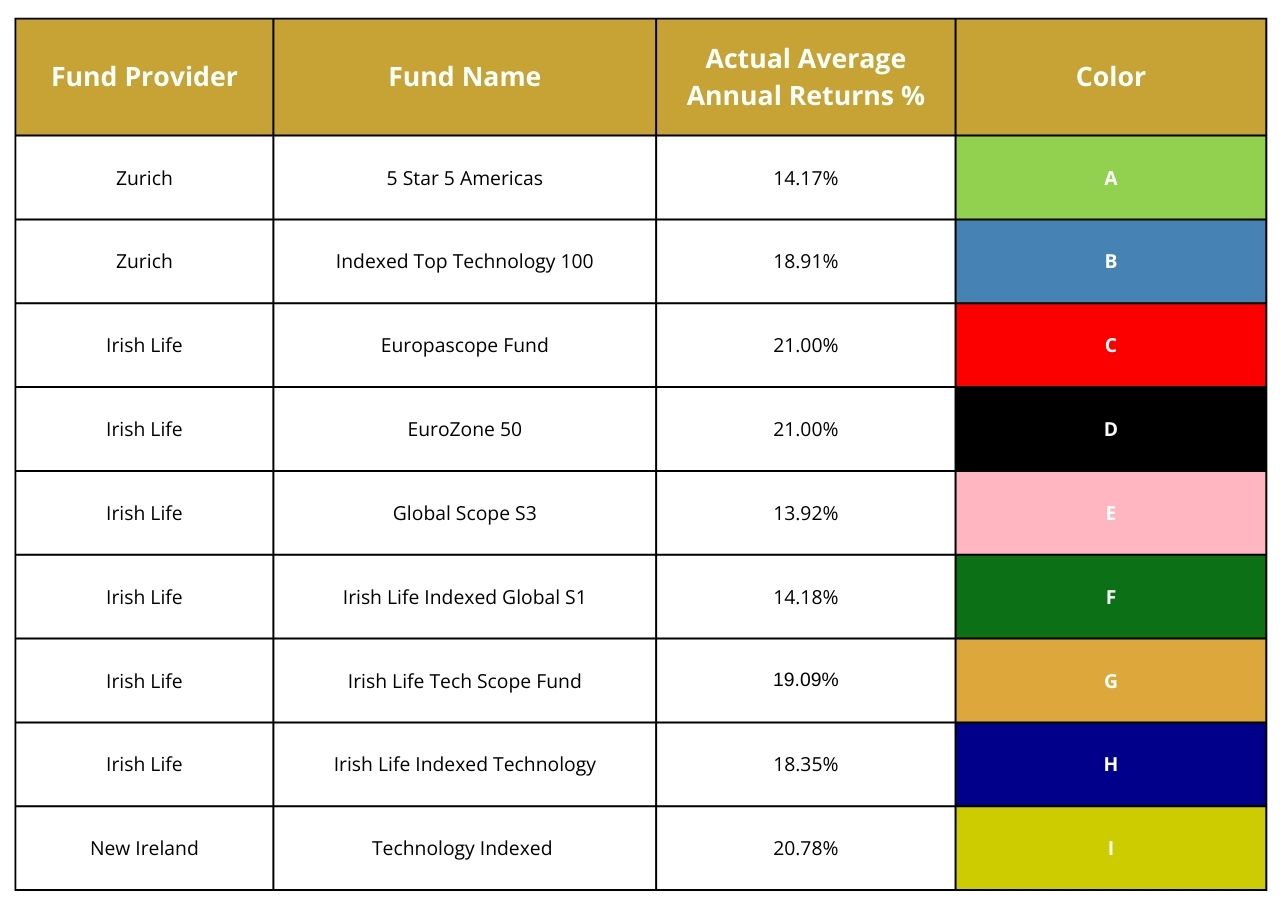

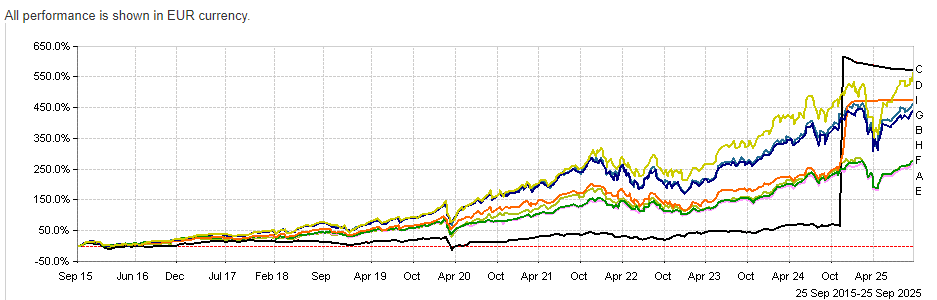

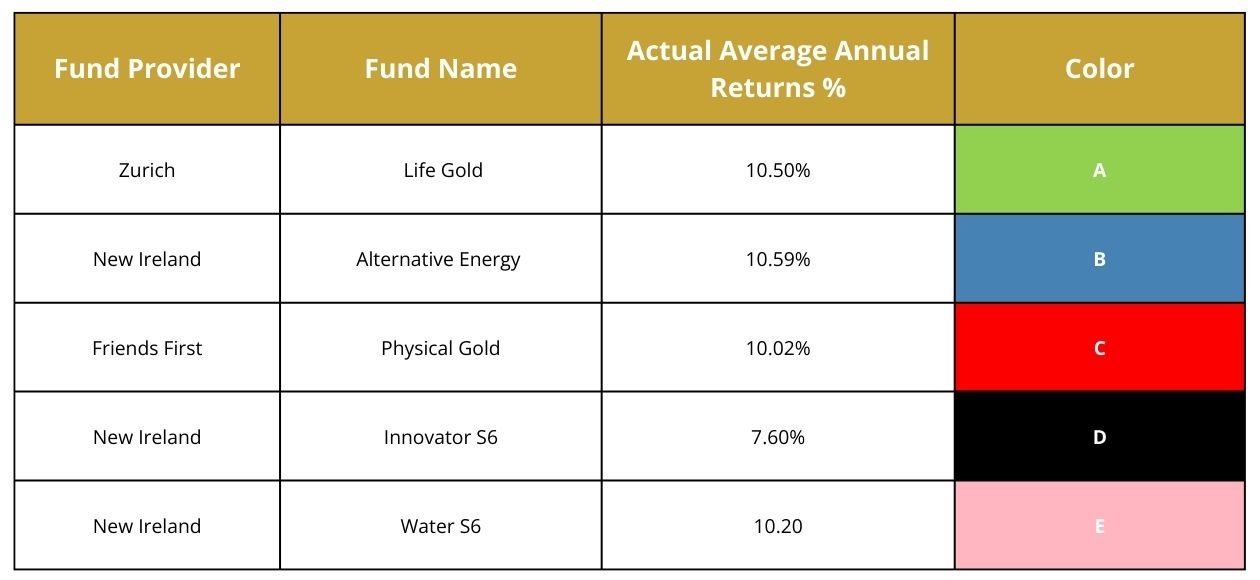

Below is a table of actual average annual returns over the past 10 years generated from some popular investment funds offered by these main providers for all savings plans.

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Are you ready to leap investing in Ireland? Whether you’re a complete novice or just looking

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

If you would like assistance in starting a Regular Saver Investment Plan or comparing providers to find the one that best suits your needs, please schedule a call with one of our highly qualified financial advisors.

Money Maximising Advisors Limited is regulated by the Central Bank of Ireland – C154250