Public Sector Superannuation Advice

- Home

- Public Sector Superannuation Advice

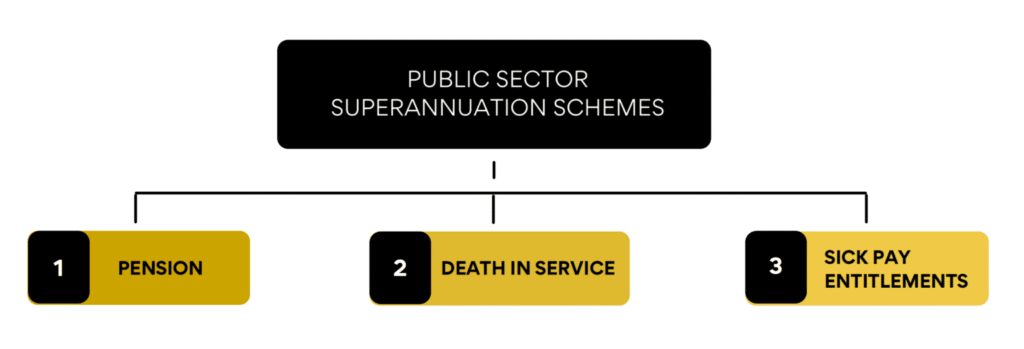

Public Sector Superannuation Schemes

Public Sector Superannuation schemes can be quite complex and difficult to understand. Our team of Advisors have vast experience with advising public servants on these schemes.

Below is some of the main financial queries which we help our clients calculate and understand:

The majority of Civil Servants who commenced full-time employment in a public sector position is a member of one of the 2 main Superannuation schemes.

- Pre-2013 Superannuation Scheme

- New Single Superannuation Scheme – Post-2013

Both of these schemes provide life insurance, sick pay entitlements and pension benefits to its members.

In order to qualify for these benefits, contributions must be made to earn these benefits.

Compulsory Contributions to earn Superannuation Entitlements

The 2 main compulsory contributions are as follows:

Pension Contributions

- For each payslip, a contribution of roughly 5% of your Gross (before Tax) earnings is made.

- These are compulsory contributions and are usually visible on each payslip (right-hand side). The deductions can be named differently on your payslip, depending on which department you are being paid from. The most popular titles for these deductions are:

- Pension Grouped

- Pension 170

- Additional Superannuation Contributions (ASC)

Spouses and children’s Benefits’ deduction

Another compulsory deduction that is visible on most payslips is called Spouses and Children’s benefit. This can often be named ‘1.5% Sp &Ch’ on your payslip. This deduction entitles you to a Death-in-Service benefit (see below)

Superannuation Benefits and Entitlements

Every year you work, you earn entitlements as a public servant from whichever superannuation scheme you are a member of.

The benefits and entitlements are calculated differently with each scheme. Generally speaking, the Pre-2013 scheme benefits are more significant, particularly when comparing the pension entitlements.

The tax-free lump sum and pension entitlements are roughly 40% more with the Pre 2013 scheme than the post-2013 scheme.

Pension Entitlements

- Tax-Free Lumps sums and annual pension calculations

- The implications of retiring early, resigning/leaving the public service, taking a career breaks or unpaid unpaid leave etc

- Retiring on Cost Neutral grounds

- Retiring on ill health Grounds

AVCs

- whether you are overfunded or underfunded

- The tax implications of any AVC Funds on retirement (if overfunded)

- How to use AVCs to max out your Tax-free lump sums

- Whether you should start, stop or restart your AVCs

Last Minute AVCs

- When these are required and how to set up/draw down these funds

- Sick Pay Entitlements

- Death In Service Entitlements

- Spouses and Children’s Benefit

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

Get in touch with us

To schedule a call with one of our Qualified Financial Advisors.