Overseas Pension Advice

- Home

- Overseas Pension Advice

Learn How To

- Locate your overseas pension

- Get up to date documentation and fund valuation

- Analyse whether or not it makes financial sense to transfer

- The Tax implications of transferring it from the residing country of pension

- Enquiring about any double taxation agreements between Ireland and the foreign durestrictions

- How to transfer the pension to Ireland

- How and when this pension can be accessed/retired

- The possibility of transferring your foreign state pension entitlement credits to increase your Irish State pension entitlement.

THE MAIN BENEFITS OF TRANSFERRING YOU PENSION BACK TO IRELAND ARE

If you are someone who has worked abroad and have not yet transferred your pension, it may be worth your while to look into this in greater detail. It is however, very important that you do your homework before any decision is made as it may or may not be the best decision for you. In some circumstance the tax implications of transferring it to Ireland may be too significant. Alternatively, in other circumstances, there maybe a way of claiming a tax rebate from this foreign duristriction on the tax paid as a consequence of a double taxation agreement between Ireland and that country.

- The possibility of getting an Enhanced Transfer Value on your pension, particularly if this overseas pension is a defined benefit pension.

- It may also be possible for the you to get access to this pension money from age 50 onwards. It can be age 55 with some countries (UK).

- It can reduce currency risk once it is transferred into Euro. This is especially relevant for people who worked in the UK due to the uncertainty around Brexit and the impact it will have on the British pound verses the Euro.

- The individual has full control over this money once its transferred. The individual can invest this wherever he/she wants within revenue rules. Its even possible to use this money to buy property or invest in a company etc

- The main benefit of transferring your pension is that upon death, your full pension value is left as inheritance to your loved ones. This is not necessarily the case if the pension is left where it is.

Overseas Pension Advice

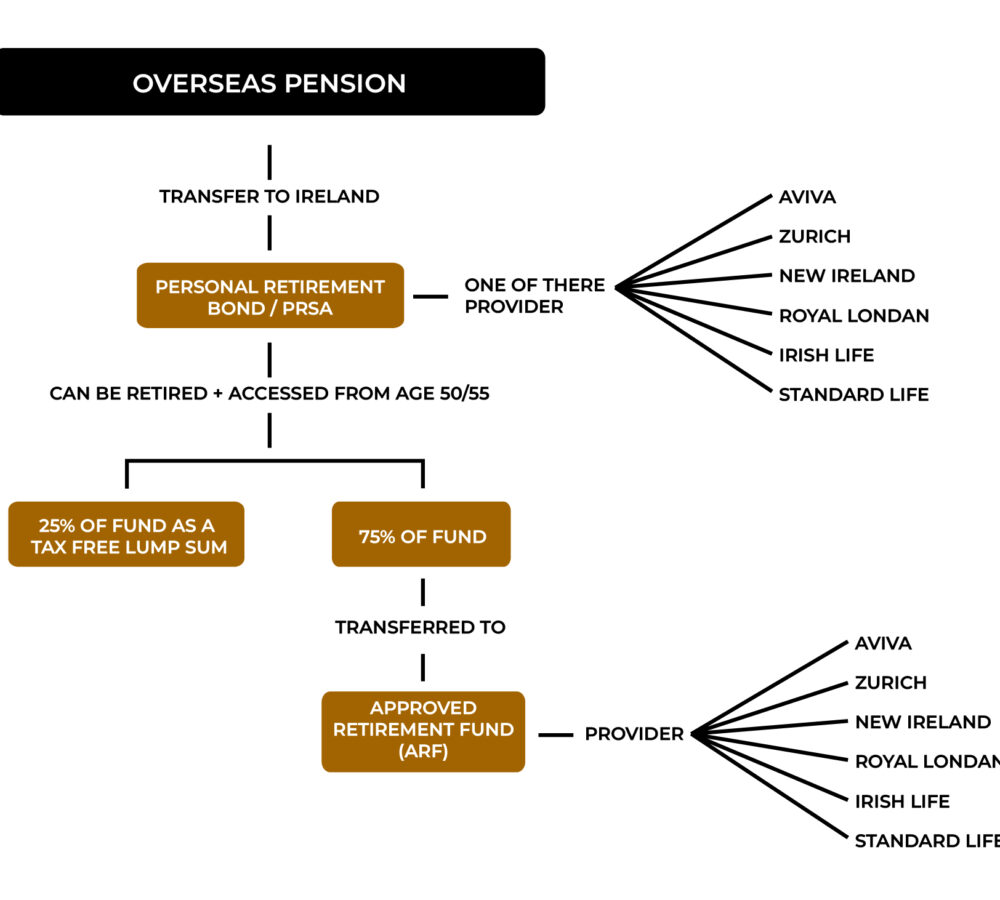

How does this overseas pension transfer process work

If you decide to transfer you overseas pension to Ireland, the transfer value (provided by your previous employer) is transferred to Ireland and into either a Personal Retirement Bond or a PRSA. All Pension providers have these pension vehicles (Zurich/Aviva/Royal London/Irish Life/Standard Life/New Ireland Assurance).

Please see illustration below.

Once the money has been transferred from your ex-employer to Ireland, you have the option of retiring and accessing your Personal Retirement

bond (age 50)/PRSA (age 60). Your funds will be accessed as follows :

- 25% of the Pension value is received as a tax-free lump sum.

Once the money has been transferred from your ex-employer to Ireland, you have the option of retiring and accessing your Personal Retirement

bond (age 50)/PRSA (age 60). Your funds will be accessed as follows :

- 25% of the Pension value is received as a tax-free lump sum

- The remaining 75% is then transferred into an Approved Retirement Fund (ARF)

- This is another pension vehicle where all withdrawals taxable as income

- A minimum withdrawal of 4% is compulsory from age 61 and must be made each year

- It is at your discretion how much more/if any you withdraw from this pension pot from 61 onwards.

other features and benefits

State Pension Entitlement in Ireland and abroad

In order to be entitled to a state pension entitlement in either Ireland or a foreign country, you need to have paid taxes to entitle you to a pro rata state pension. In Ireland these contributions are call A1 PRSI contributions.

There was a rule change in September 2022 State Pension Entitlements. There has been a move to a Total Contributions Approach (TCA) as a basis for calculating the quantum of the state contributory pension. You will need 40 years contributions to get the full amount, and anything less is pro rata.

State pension entitlements from foreign jurisdictions can be transferred to Ireland to entitle you to a higher state pension entitlement here if you so please. The combination of all the above, when transferred could entitle you to a full state pension entitlement. Alternatively, you can keep these state pensions separate.

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

Get in touch with us

To schedule a call with one of our Qualified Financial Advisors.