Additional Voluntary Contributions

- Home

- Additional Voluntary Contributions

WHAT IS AN AVC?

An AVC is an Additional Voluntary Contribution that you can make in addition to your normal contributions to an occupational /company /employer pension scheme in the public or private sector to increase your retirement benefits.

The main purpose of AVC’s is to bump up your pension benefits that your employer’s pension scheme is providing for you.

Please see the infographic of how company/occupational pensions work.

If you are a member of a company/occupational pension scheme, both you and your employer usually contribute into your pension fund. AVCs on the other hand are, as their name says, voluntary, so it is usually only the employee that contributes into this additional pot of pension money. These additional contributions still qualify for tax relief at your marginal rate of tax that you pay (subject to revenue limits).

AVC Access

Access to your AVC pension pot is restricted to the access/draw down rules of your main employer pension scheme. This is usually age 60-65.

DO YOU NEED AN AVC?

AVCs can be a very beneficial way of saving, but if you are thinking of starting an AVC, it is advisable to do some number crunching to assess the tangible tax benefits of your contributions. All AVC contributions qualify for tax relief at your marginal rate of tax, but many employees (especially civil servants or members of Defined Benefit Pension schemes) may find themselves paying a huge tax bill on these funds on retirement.

For example, if a member of a defined benefit pension scheme is overfunded in their AVC, their fund may be liable to a 52% tax charge on retirement. Alternatively, if the same employee has a tax free lump sum shortfall, then they usually pay no tax on their AVC pension pot when you draw it down at retirement.

So as you can see, it is very important to do some financial planning before deciding whether to start, stop or restart your AVC.

In many cases there may be no real tax relief or benefit of paying into an AVC as opposed to a Regular Savings plan. (A comparison of AVCs vs Savings is explained below.)

AVC Vs Regular Saving Plan

Example 1

The info-graphic below compares an employee on a marginal rate of tax and the difference between contributing €100 of his Gross (pre tax) wages into an AVC vs a Savings plan.

As you can see from above, the AVC contributions are made on the employee’s gross (pre-income tax) earnings of €100 as compared to his net income (post income tax) of €60 with a savings plan. (Please note the above example ignores charges).

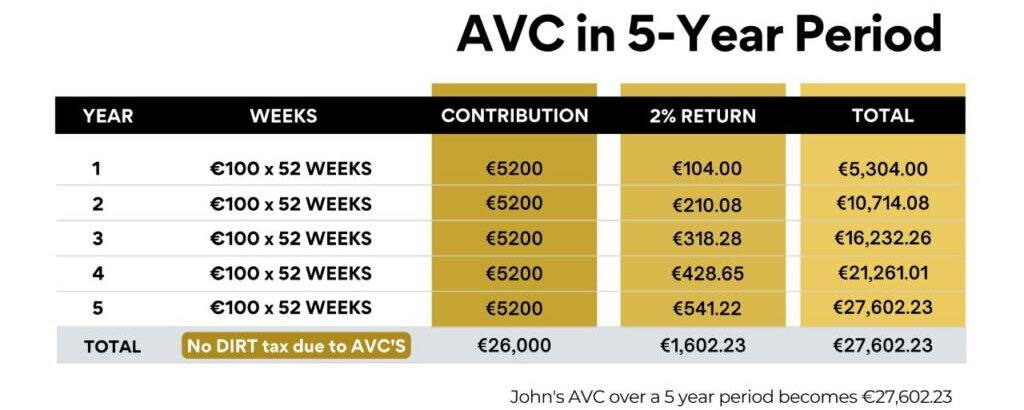

The extra €40 that goes into your AVC due to the relevant tax reliefs can have a hugely positive impact on your fund over a long period of time. The info-graphics below compare an employee, who is in the 40% income tax bracket, contributing the same gross wages (€100) to both an AVC and a Savings Plan on a weekly basis over a 5-year period.

Saving IN 5 Year period

Example 2

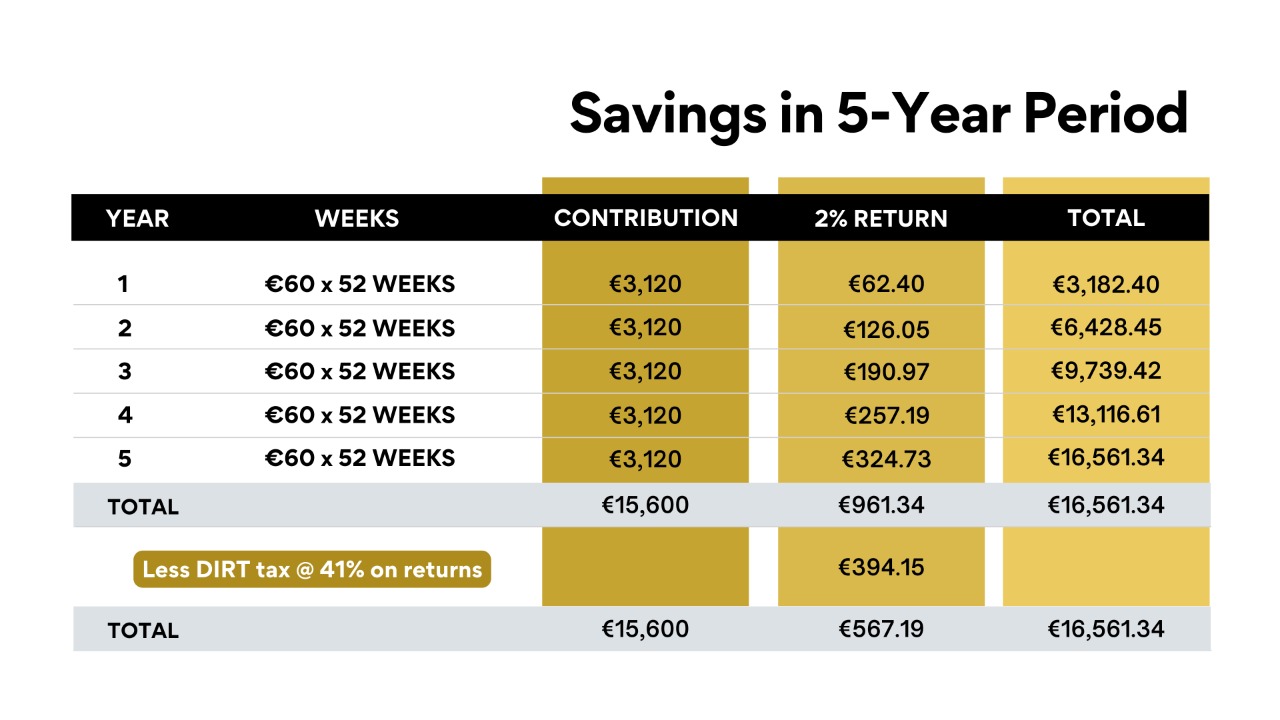

As John’s contributions into his savings is (post income tax), his contributions are only €60 per week. See below.

AVC And Saving

Example 3

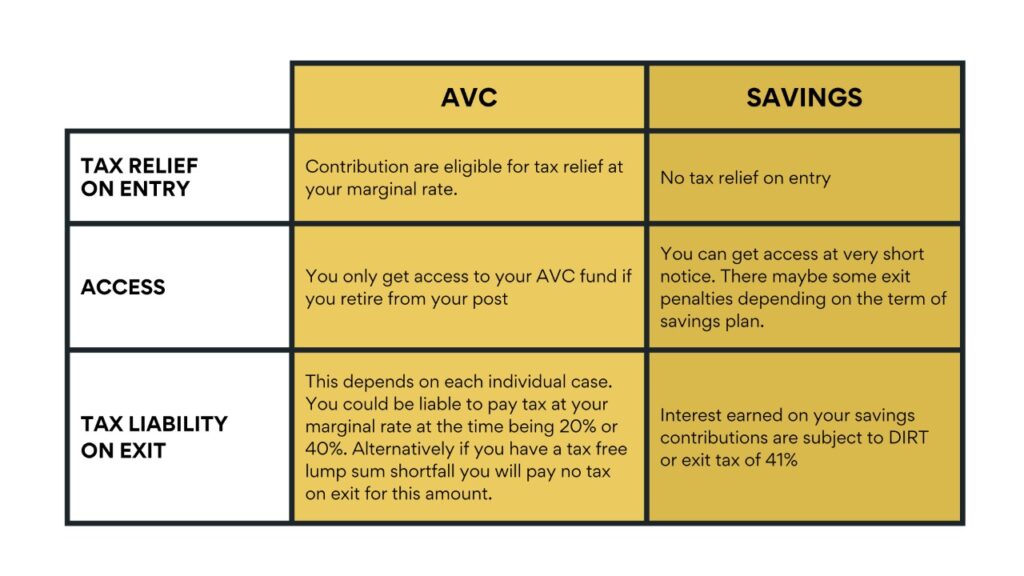

The table below shows a summary of the differences between an AVC and Savings.

Public Sector AVC

If you are a public sector employee, AVCs are a very popular form of savings. Please click on the button below which goes into more detail about Public Sector AVCs.

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

Get in touch with us

To schedule a call with one of our Qualified Financial Advisors.