Serious Illness Cover

- Home

- Serious Illness Cover

Get in Touch With Us

STEP 1

Get A Free Instant Quote

STEP 2

Fill Out Medical Form

STEP 3

E-sign & Submit To Insurance Company

STEP 4

Once Approved , Select Start Date

STEP 5

Your Now Covered You”ll Recieved Your Policy By Post

What is Serious Illness Protection?

Serious illness cover provides a tax-free lump sum if you are diagnosed with a serious illness during the term of the policy.

Here is a list of the main illnesses covered:

Cancer, Heart, Stroke, Alzheimer’s Disease, Chronic Rheumatoid Arthritis, Motor Neurone Disease, Multiple Sclerosis, Paralysis of a limb, Parkinson’s Disease etc. * Full details of Specified Serious Illness Cover and the Terms and Conditions which apply are contained in the relevant Policy Conditions.

Why the need for Serious Illness Cover?

Serious illness policies provide you with a tax-free lump sum in the event of you being diagnosed with one of the specified serious illnesses covered on your policy. There are over 50 specified illnesses covered and partial payouts for over 20 specified illnesses. Serious illness cover can be combined with life cover under the one policy.

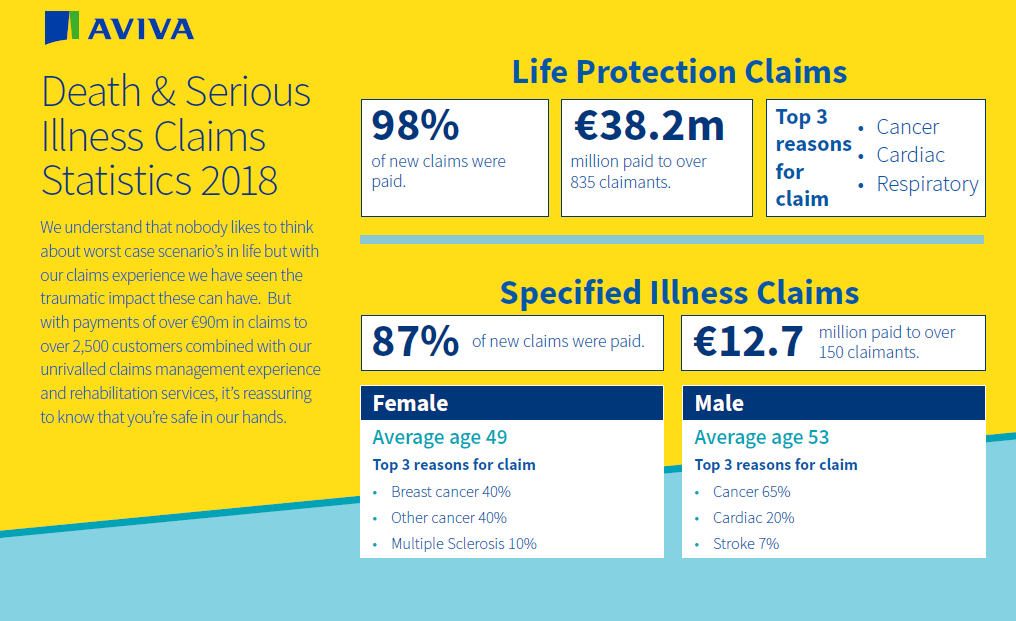

Serious Illness Cover Claim Statistics

Unsure if Serious Illness Protection is the right choice for you? Don’t know what is a fair monthly premium to expect? Questions about the process?

We’re here to help! You can use our chat box in the bottom corner to speak to a Financial Advisor at no cost. We also have frequently asked questions below that you can have a read through.

TYPES OF SERIOUS ILLNESS POLICIES

Q1. Stand Alone/Additional Serious Illness Cover

Ans: This cover allows you to choose a specified serious illness cover which is independent of any life cover under the policy. This means if you make a claim on your specified illness cover, your life cover remains unaffected. You can also choose to take out stand-alone specified serious illness cover on a completely independent basis. i.e. without any life cover at all. Stand-alone specified serious illness cover is only available on term assurance policies.

For example: Tom takes out a life and specified serious illness cover policy on his own life. He takes out €250,000 life cover and €100,000 stand-alone specified illness cover. Unfortunately, sometime in the future, Tom suffers a heart attack. After successfully claiming for a heart attack, he receives €100,000 from his specified serious illness cover as this cover was set up from the outset on a standalone basis. Tom’s specified serious illness cover payment of €100,000 does not affect the life cover amount which remains in place at €250,000. After his claim, Tom’s monthly premium is also reduced to reflect his remaining cover.

Q2. Accelerated Serious Illness Protection

Ans: This cover is a combination of life cover and specified illness cover. In the event of a successful claim on one of the specified serious illnesses, your life cover will be reduced by the amount of the specified serious illness cover claim. For accelerated illness cover you can choose the amount of specified serious illness cover you require, from 10% to 100% of your life cover. Accelerated specified serious illness cover is available on both term assurance and mortgage protection policies.

For example Mary takes out a policy on her own life with €250,000 life cover and €100,000 accelerated specified serious illness cover. Sometime in the future, Mary, unfortunately, suffers a stroke. After successfully claiming on her policy, she receives €100,000. Whilst Mary’s specified serious illness cover is now used up, her life cover continues but is reduced by the amount paid out by the serious illness in this example €100,000. So now she has €150,000 life cover for the remainder of the policy. Mary’s monthly premium is also reduced to reflect her reduced cover.How much Serious Illness cover do I need?The general advice is to have 2 to 4 times your income in serious illness cover. So if you earn €50,000, you should have between €100,000 and €200,000 serious illness cover.

Q3. Permanent Total Disablement

Ans: This benefit is payable if you or someone covered on your policy becomes permanently, totally and irreversibly unable to perform current working duties. You do not necessarily have to be suffering a serious illness; a significant bodily injury may result in you being in a position where you need to claim Permanent Total Disablement benefit. This option is always paid as an acceleration of the serious illness sum insured, which means that the amount of serious illness you have reduces by the amount paid out to you.

Q4. Terminal Illness Benefit

Ans: This is a standard benefit that can be provided (excluding Income Protection) where life cover has been selected as the main benefit, at no additional cost. It is payable if, in the opinion of an attending Consultant and the Company’s Chief Medical Officer, the life assured’s life expectancy is no greater than 12 months.

Q5. Surgical Cash

Ans:In the event that you require major surgery, you will receive a payment of 10% of the serious illness sum insured, up to a maximum of €25,000. If you require intermediate surgery, you will receive a payment of 5% of the serious illness sum insured, up to a maximum of €12,500. The intermediate and major surgeries covered are listed in your policy document.

Q6. Personal Accident Benefit

Ans: The Personal Accident Benefit is paid for each week you are unable to work in your current occupation as a direct result of an accident. It will be the lesser of half your weekly earnings or the amount of benefit you decide to cover yourself for. It pays a maximum of 52 weeks during the term of your policy.

Q7. Hospital Cash

Ans: If you are admitted to hospital in Ireland as an in-patient for more than three days (72 hours), your policy will pay the amount of Hospital Cash benefit you choose multiplied by the number of days (24 hours) you are in hospital to a maximum of one year (365 days) during the term of your policy.

Q8. Children's Cover

Ans: No one wants to think about their children becoming seriously ill or prematurely dying. However, it is important to note that your policy can provide some financial support in these very unfortunate circumstances. It can provide you with money to help cover medical and funeral costs, if required. Financial support will also be provided to help with medical related expenses (such as hospital stays, accommodation for parents or having to travel abroad) if a child suffers one of the specified serious illnesses.

Q9. Inflation Protection Option

Ans: If you include the Inflation Protection option on your policy, you will have the option each year to increase your premium and cover by specific amounts to protect against inflation (4.5% for your premium and 3% for your sums insured which may vary with the different insurance companies).

Q10. Protection Continuation Option

Ans: This option allows you to extend the benefits provided by your policy at any stage during the term, without providing further medical evidence. The option must be selected on the application form at the start date of the policy.

Q11. Waiver of Premium Benefit

Ans: This benefit gives you the added security of knowing that if you are unable to work because of injury or illness, your policy will pay your premiums after a period of 26 weeks has passed. Payments will stop on your recovery, at the end of the policy term, your 60th birthday or death, whichever is earlies

Q12.Guaranteed Insurability

Ans: This benefit gives you the option to increase your cover without further medical evidence on the birth of a child, marriage, registered civil partnership, promotion (in certain circumstances), or in the event that you gain approval for a new mortgage or increase to an existing mortgage and subsequently draw down these funds.

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

Get in touch with us

To schedule a call with one of our Qualified Financial Advisors.