Last Minute AVC: What is the Last Minute AVC Rule?

AVCs – Additional Voluntary Contributions, a key element in securing your financial future. Today, we delve into a specific aspect that could make a significant

The main purpose of AVC’s are illustrated below

Ans: AVC’s can be used to buy back years of service and retire from you job earlier. However, this rarely makes financial sense as buying back one year of service is often too expensive to make be a viable option. For example it can cost up to €20000 to buy back 1 year of service. It can often take up to 40 years receive back the €20000 in annual pension income.

Ans: If you have a tax free lump sum shortfall, you can withdraw up to this amount tax free from your AVC. Your tax free lump shortfall is the difference between the lump sum earned from your years of service verses the maximum allowed lump sum (1.5 times Final Salary). You will usually have a shortfall.

Please note that if you have excess funds in your AVC over and above your tax free lump sum shortfall, the excess funds will be taxable as income on retirement. It is important to work you’re your shortfall before starting contributing into AVC’s.

Ans: Once you have withdrawn your tax free portion of your AVC, any excess funds is usually transferred into an Approved Retirement Fund. Once these funds are withdrawn from the ARF, they are taxable. Its always prudent to withdraw these funds tax efficiently each year to avoid paying any unnecessary income tax.

Ans: Public servants or even spouses who are public servants can use AVC’s to reduce any tax liability due on self employed income. As all contributions into AVC’s qualify for tax relief, the tax rebate can be offset against any tax liability due by 31st of October each year. Lumps sum contributions are usually used in these circumstances. Its important to note that there is a limit on how much an individual can contribute into AVC’s each year and qualify for tax relief. This limit is directly correlated to your age and Annual Gross earnings. However you can backdate unused tax relief to the previous years income.

Ans: If you are in receipt of bonuses or commissions from your main occupation, almost half of these payments are taken by the revenue through income tax etc. AVC’s can be used to avoid paying income tax on these payments as all contributions into AVC qualify for tax relief etc.

Access to your AVC funds are restricted to your retirement age. The funds are drawn down in line with your main public sector pension benefits.

Both Regular and Lump sum contributions can be made to AVCs. All AVC contributions qualify for tax relief at your higher/marginal rate of

When regular (fortnightly/monthly) contributions are being paid into AVCs, the tax relief is also received simultaneously. Regular contributions can be made in 2 ways

With Salary deduction method, the AVC contributions are transferred to the AVC before the income tax is subtracted. This is called getting tax relief at source.

With the Non Salary Deduction method, the Gross AVC premium is debited from your bank account each month. The tax rebate (usually 40% of the AVC premium) is added back to your take-home pay on your payslip on a monthly basis.

There is no real difference between the 2 methods. You are receiving your tax relief either way. We would always recommend the non salary deduction as it give you much more flexibility in relation to;

(stopping/restarting/

increasing/decreasing them etc)

Once your policy goes live, the relevant insurance provider sends an AVC Certificate to the revenue to prove that your policy is now live and instructs them to alter your tax credits accordingly.

When the revenue completes this task, you will receive the relevant tax rebate back in your tax home pay monthly. You will notice an increase in your take home pay by the rebate amount once the revenue alters your tax credits.

It may take 6 weeks or so after your start date before you start receiving your rebate but all tax relief due will be backdated and paid in full once your tax credits are adjusted etc. There is no action required by you to qualify for tax relief. This will all be done for you by the chosen AVC provider and your local tax office.

When lumps sum contributions are made, the tax relief is received in a lump sum also.

A Multi Asset Fund Is An Investment Put Together By An Investment Provider/insurance Company(Aviva/Irish Life etc.). It Is Made Up By A Mixture Of 5 Asset Classes:

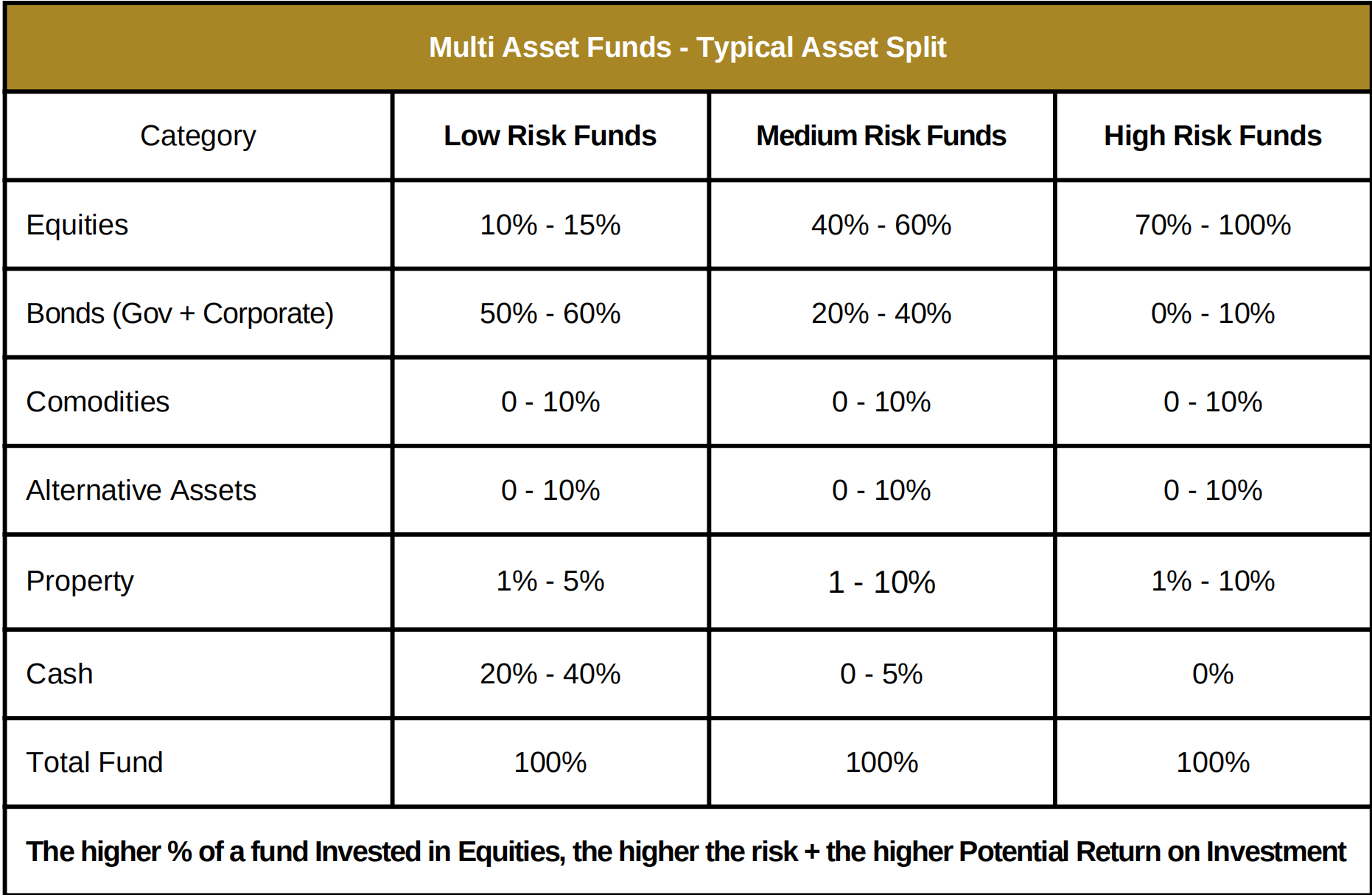

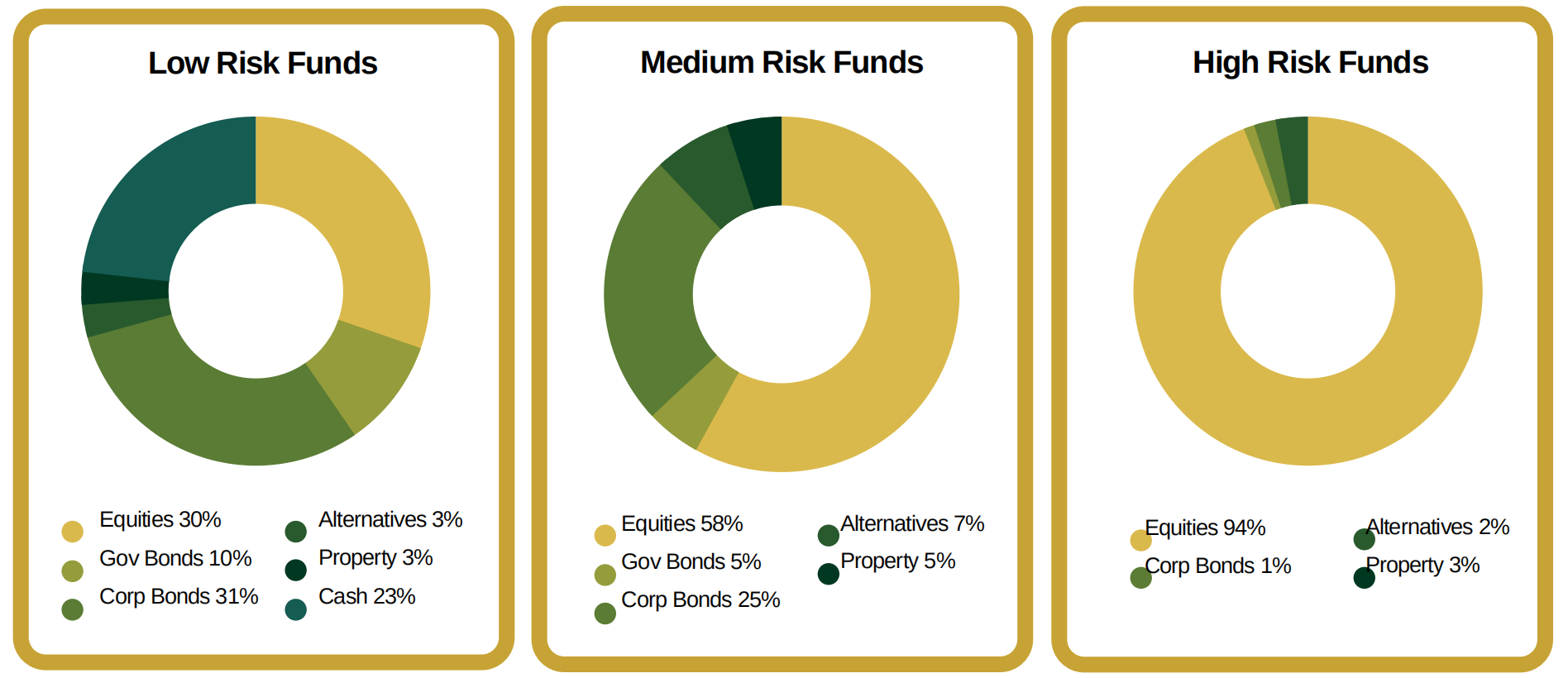

The Investment Providers Usually Have Multi-asset Funds For Low, Medium, And High-risk Investors.Please See Below A Typical Breakdown Of The Percentage Of A Typical Low, Medium, And High-risk Fund:

Each insurance company has hundreds of different multi asset ranges of funds. As Investment brokers, we have Agency arrangements with all of the providers namely IrishLife, New Ireland Assurance, Aviva, Standard Life, Royal London etc.

We are an advice driven business and it is our job to search all the multi asset funds through out all the different providers and recommend the best one for you. We have no preferential arrangements with any one Provider.

We search the market place and compare multi asset funds with in your risk tolerance level and then make our recommendations to clients.

In order to set up your AVC, the following steps are required;

The application along with your Anti Money Laundering documents are then submitted to the chosen AVC Provider to be processed and a policy number created on their system. This can take between 2 to 4 weeks.

AVCs – Additional Voluntary Contributions, a key element in securing your financial future. Today, we delve into a specific aspect that could make a significant

After retirement, everyone wants to enjoy a relaxed, joyful and abundant life – without any restrictions. And to do that smoothly, many of us will

Are you facing retirement and thinking about how to make the most of your hard-earned money? Well, look no further! In this blog post, we’re

To schedule a call with one of our Qualified Financial Advisors.