Over 50s Funeral Cover

- Home

- Over 50s Funeral Cover

What is Funeral Cover?

Taking out Life Insurance in your 50s can ensure that a lump sum of money is left to your loved ones when you die to cover the costs of your funerals and to give you a good send-off.

The average cost of a Funeral Cover nowadays can range up to €30,000 with coffin, burial plot and headstone, along with refreshments after your burial. Someone will have to pay for this, why not have a life insurance provider pay for it instead of your family having to?

The cost of this plan will depend on how much money you would like to leave behind.

Why get over 50's Funeral Cover?

- Leave a pleasant financial surprise behind for your loved ones

- Cover the costs of your funeral (Coffin, tombstone, burial plot)

- Pay for refreshment on your funeral day for your close friend and family and give yourself a good send-off.

- Leave the feeling of generosity, unselfishness and gratitude behind.

Over 50s Funeral Cover- How it works

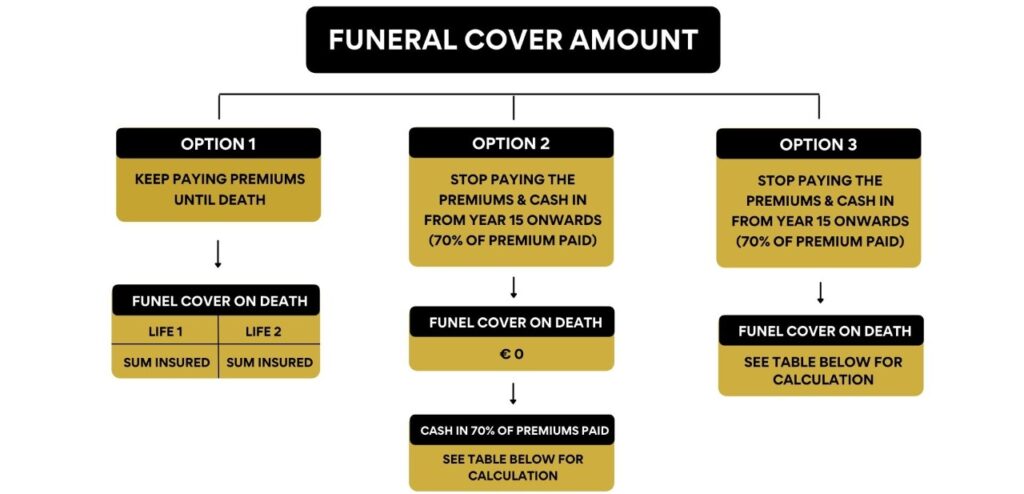

You choose how much cover you would like and whether it is a single or dual life policy (two people). This policy has a huge flexibility in relation to its payout options. The diagram below explains the 3 main options.

From year 15 onwards, you have the option of either;

- keep paying premiums until death.

- cash in your policy and get up to 70% of your premiums back.

- stop paying the premiums and settle for a reduced life cover payout that will pay on your eventual death.

Know the future of investment

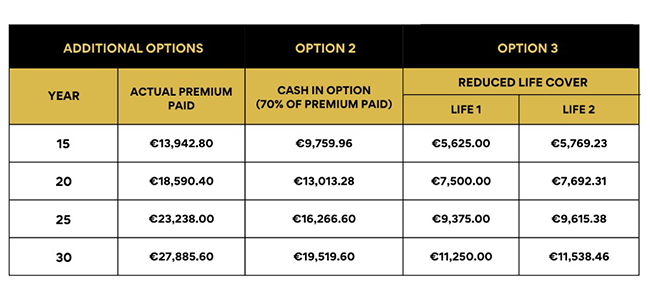

The following calculations would apply for €15000 funeral cover for male 60 and female 61, non smokers covering both of their lives with thee monthly premium of €77.46.

Below are the calculations for option 2 and 3 from year 15, 20, 25 and 30 respectively;

other features and benefits

What Do I Need to Consider When Buying Insurance?

- The policy is owned by you and not part of a group scheme

- The policy also pays an additional hospital Cash payment if you are required to stay overnight in the hospital

- Back-to-work rehabilitation programs (including physio) available for all policyholders

- Free complimentary counseling sessions for the applicant and their families are available

- The premiums are guaranteed and do not increase for the term of the policy

- There is no obligation to be a member of any trade union

- A very high percentage of payout on genuine claims

- You can change jobs throughout your career and keep this policy

Summary of the main points of the this policy

- Once the first premium is paid, this policy guarantees that the funeral cover sum insured will be paid out on death for the life(s) insured.

- This sum of money is paid to your estate on death. They don’t necessarily need to spend the funds on funeral expenses…..its their choice.

- If you keep paying the premium for 15 years or more, the policy will guarantees to paid out a sum of money. What is paid out depends on which option you choose (explained above).

- The premiums stay the same for the duration of the policy (unless the indexation is chosen).

- The premiums quoted above are subject to your application being accepted at standard rates. Ongoing health issues may increase premiums.

Money Maximising Advisors Ltd are regulated by the Central Bank of Ireland C154250

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

Get in touch with us

To schedule a call with one of our Qualified Financial Advisors.