Directors Pension

- Home

- Directors Pension

DIRECTORS/EXECUTIVE PENSIONS

Imagine taking the pain of setting up a business and then walking away from it empty-handed when you retire? Not a pleasing scenario – certainly not the outcome you want for you when the day comes for you to walk away. You don’t want to see all your effort, struggle, and sacrifice go all unrewarded. This is why you must plan the exit from your business in advance.

And you can do that by starting a Directors pension. A directors pension (also known as an executive pension) is one of the best financial ways to save money and increase your wealth while you’re still working. This pension plan facilitates the transfer of cash from your company’s bank account into your long-term savings account. An amazing plan to save up for your retirement in a tax-efficient way.

TURN BUSINESS PROFITS INTO RETIREMENT WEALTH WITH DIRECTORS PENSIONS

Please see the infographic of how company/occupational pensions work.

If you are a member of a company/occupational pension scheme, both you and your employer usually contribute into your pension fund. AVCs on the other hand are, as their name says, voluntary, so it is usually only the employee that contributes into this additional pot of pension money. These additional contributions still qualify for tax relief at your marginal rate of tax that you pay (subject to revenue limits).

AVC Access

Access to your AVC pension pot is restricted to the access/draw down rules of your main employer pension scheme. This is usually age 60-65.

Extracting profits from your business

If your company has made profits in a particular year, there are 4 ways in which you can extract these profits from the business

- Pay yourself extra salary/commissions/bonus

- Pay dividends to the shareholders

- Make Pension Contributions

- Make a Corporate investment

All of the above have tax implications for either the directors or the company. The most tax efficient method of method from all of the above is by far, contribution into a directors pension.

2 Tax benefits of Directors Pensions

Example 1

Director Pension contributions are made from the company bank account into this pension vehicle. These contributions can be made monthly or annually. The annual contributions are usually made in a lump sum at year end in order to reduce your corporation tax liability.

The following tax benefits apply to these contributions

- There is no personal tax liability (PAYE/PRSI/USC) or BIK for the directors

- the companygets corporation tax relief (12.5%) on the contributions being made.

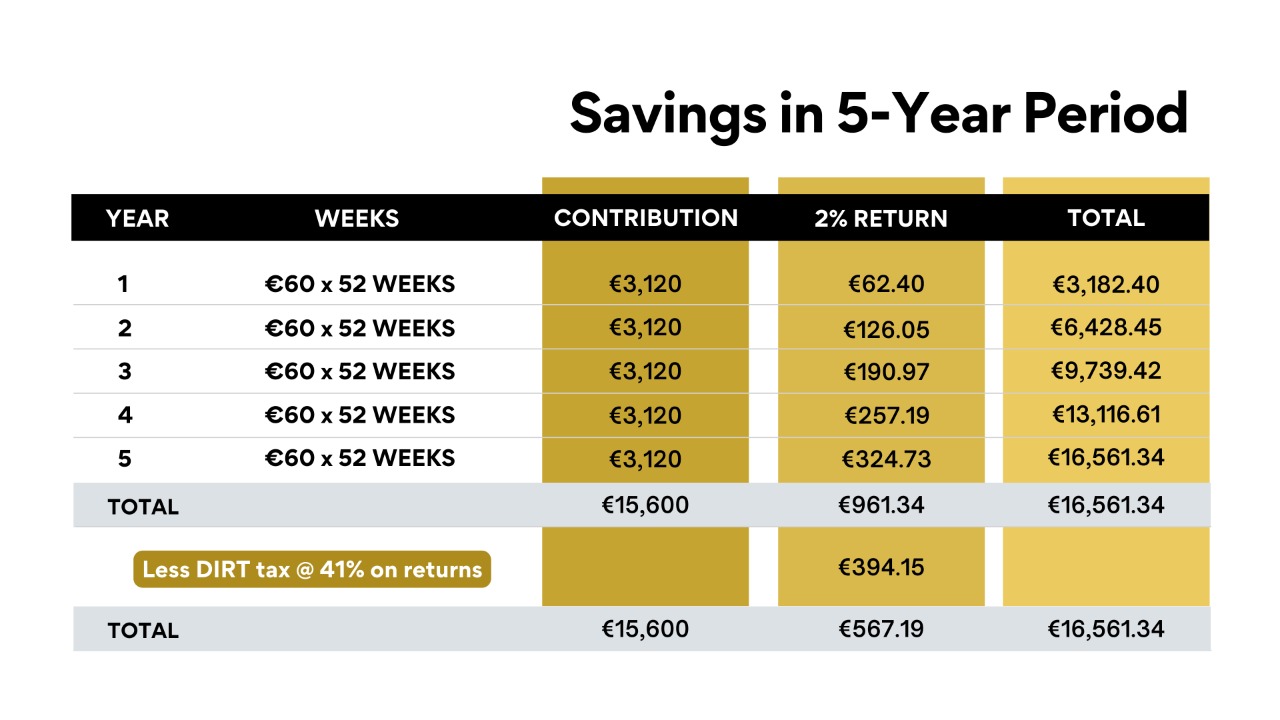

- The Pension contributions, when invested, benefits from tax free growth for the entire term of the pension plan. The compounded (tax free) interest effect of making consistent returns over a 10-20 year term can have a hugely positive impact on the overall pension fund value.

All other methods of extracting

Money from your company has tax implications

Salary: (PAYE, PRSI & USC): 52%+

Dividends: 25%– 40%

Capital Gains: 33%

Benefit in Kind (company cars etc):30%

Pension contributions 0%

Building Yourself Into The Business Plan

Smart business owners structure their companies in a way that serves them.

It can be easy to forget that your business is ultimately there to serve you.

As a director, you are in the unique position of being able to combine your current income needs and future income needs into one coherent plan.

And that plan is the amount of money you accumulate by the time you step away from your business.

Once you’re set up you can be confident that your business is actively building your net worth each month.

How Are Director Pension Entitlements Calculated?

Revenue Commissioners will allow you to build a retirement asset up to a limit of €2,000,000 as a company director.

However, the actual amount you can target under revenue rules is determined by a formula which is determined by your;

- Age

- Gender

- Marital Status

- Retirement Age

- Annual Income

- Potential Service

- Existing pension values

A Standard ‘Max Funding Pensions calculator’ is used to determine how much, each year a director can contribute into his/her pension.

Pensions contributions can be backdated 10 years in order to max out the director pension limits.

Expert Guidance on PRSA Pension Ireland for Optimized Retirement Planning

Money Maximising Advisors are experts in financial planning and investment strategies, guiding individuals with tailored advice on PRSA Pension Ireland. We empower clients in making informed decisions about their Personal Retirement Savings Account Ireland (PRSA) by creating personalized strategies aligned with long-term retirement goals. Advisors optimize contributions, select suitable funds, and maximize returns while leveraging tax benefits. Through transparent communication and continuous support, we offer a strategic approach to efficient PRSA Pension Scheme Ireland to changing financial landscapes.

The Tax-Free Cash Option For Company Directors.

Even if pensions aren’t your thing, you should still have a director scheme because you can opt for the tax-free cash option.

This allows you to build up a cash fund that can be paid out in full from age 60.

How is a Directors Pension Set Up?

Director pensions are set up under trust which means they’re legally separate from the business and you i.e. you’re building wealth independently from your business.

The legal trust is established via letter of exchange which is signed by all parties prior to going live.

Once in place, the company can make regular monthly payments on your behalf until your nominated retirement age.

What age can you access an executive pension?

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

Get in touch with us

To schedule a call with one of our Qualified Financial Advisors.