Which College Education Savings Plan in Ireland Should Parents Choose?

Planning for your child’s future is one of the most important responsibilities every parent carries. In Ireland, the rising cost of third-level education has made

🔸 Save small amounts monthly and build a strong education fund.

🔸 Save your family's children's allowance of €140 per month per child and build over €70,000 Nest Egg per child over 18 years for each child.

🔸 Flexible plans available.

🔸 You can pause or change your savings anytime.

🔸 Make lump sum contributions.

🔸 Easy access options if required within 48 hours.

🔸 Invest your money with a Provider that is fully regulated by the Central Bank of Ireland.

🔸 Invest in funds that suit your comfort level with risk (low, medium, and high risk investment options available).

🔸 Grow your money over time and beat inflation.

🔸 The earlier you start and the longer you stay invested years the greater the potential return on investment will be.

🔸 Helps ease the cost of college when the time comes.

🔸 Gives you peace of mind knowing you’re planning ahead.

🔸 Simple process - Set up application, choose a suitable investment fund, and forget about it until your children’s 18th birthday. Let compound interest grow your nest egg.

🔸 All you need to do is 'invest and forget.' Try not to stop contributing or change investment strategy, and you will have a significant nest egg to cover your children’s education.

Savings per year

The cost of third-level education in Ireland is no longer a distant concern — it’s a real financial challenge many families face today. Between tuition fees, rent, study materials, and everyday expenses, it can cost around €10,000 per year — or €40,000 over four years — to send just one child to college—even those living at home face rising costs for transport, books, and meals.

While part-time jobs, student grants, or loans may offer support, most students still need financial help from their parents. That’s why more families are now turning to a college education savings plan or education savings account to prepare.

These savings plans offer a tax-efficient education fund that transforms small, regular contributions into a powerful education investment fund. Instead of leaving your money in a low-interest deposit account, you can invest it for potential growth that keeps up with inflation.

Saving €140 per month (Children’s Allowance) from birth to age 18 could grow to over €70,000 — enough to give your child the freedom to focus on their studies, not the stress of how to pay for them.

There’s no fixed amount or perfect formula, but the most important step is to start now.

This isn’t just about covering college fees — it’s about a child’s future education planning and giving them the freedom to choose their path without financial stress.

Inflation is the increase in the price of a typical basket of goods & services. It is a measure of the general cost of living in a particular country.

Over time, a typical 100 euros will not buy the same amount of goods & services that it will today. So if your savings are not invested and generating an average net 2% return, inflation is eating into their

value/purchasing power.

The cost of college education fees, rent, clothing, and food/drink is all going to increase by the time your child is going to college – that’s a guarantee.

By investing your savings, you will hopefully put a strategy in place to keep, if not enhance, the purchasing power of your hard-earned money.

Not investing your savings and letting inflation erode it away over time is a hidden risk to all savings that goes unnoticed until it’s too late.

Although saving money in any shape or form is always recommended, investing these savings over a long-term period consistently has been proven to be an even better financially prudent decision:

Compounding your savings together with any returns generated over the longer term can have a snowball effect on the value of your savings.

Investing your children’s allowance over 18 years (from birth to your child’s 18th birthday) and generating a positive average annual return over this period can significantly increase the value of the nest egg built up.

Below is an illustration table of the potential gross value of a child’s college education plan if 140 euros were invested for 18 years, if a 5%, 6%, 7%, 8%, 9%, 10%, 11%, or 12% average return was generated over this period.

|

Monthly Contributions

|

Years

|

Total Contributions

|

|---|---|---|

|

€140.00

|

18

|

€30,240.00

|

|

Annual Contributions (€140 x 12 moths)

|

Term (Years)

|

Annualised Average net % Returns

|

Return on Investment Over Years

|

Total Gross Savings Plan Value in Savings Plan

|

Value of Saving in Bank a/c if you don’t invest

|

Variance

|

€1,680

|

18

|

5%

|

€16,685

|

€46,925

|

€30,240

|

€16,685

|

|---|---|---|---|---|---|---|

|

€1,680

|

18

|

6%

|

€21,282

|

€51,522

|

€30,240

|

€21,282

|

|

€1,680

|

18

|

7%

|

€26,405

|

€56,645

|

€30,240

|

€26,405

|

|

€1,680

|

18

|

8%

|

€32,117

|

€62,357

|

€30,240

|

€32,117

|

|

€1,680

|

18

|

9%

|

€38,486

|

€68,726

|

€30,240

|

€38,486

|

|

€1,680

|

18

|

10%

|

€45,588

|

€75,828

|

€30,240

|

€45,588

|

|

€1,680

|

18

|

11%

|

€53,509

|

€83,749

|

€30,240

|

€53,509

|

|

€1,680

|

18

|

12%

|

€62,343

|

€92,583

|

€30,240

|

€62,343

|

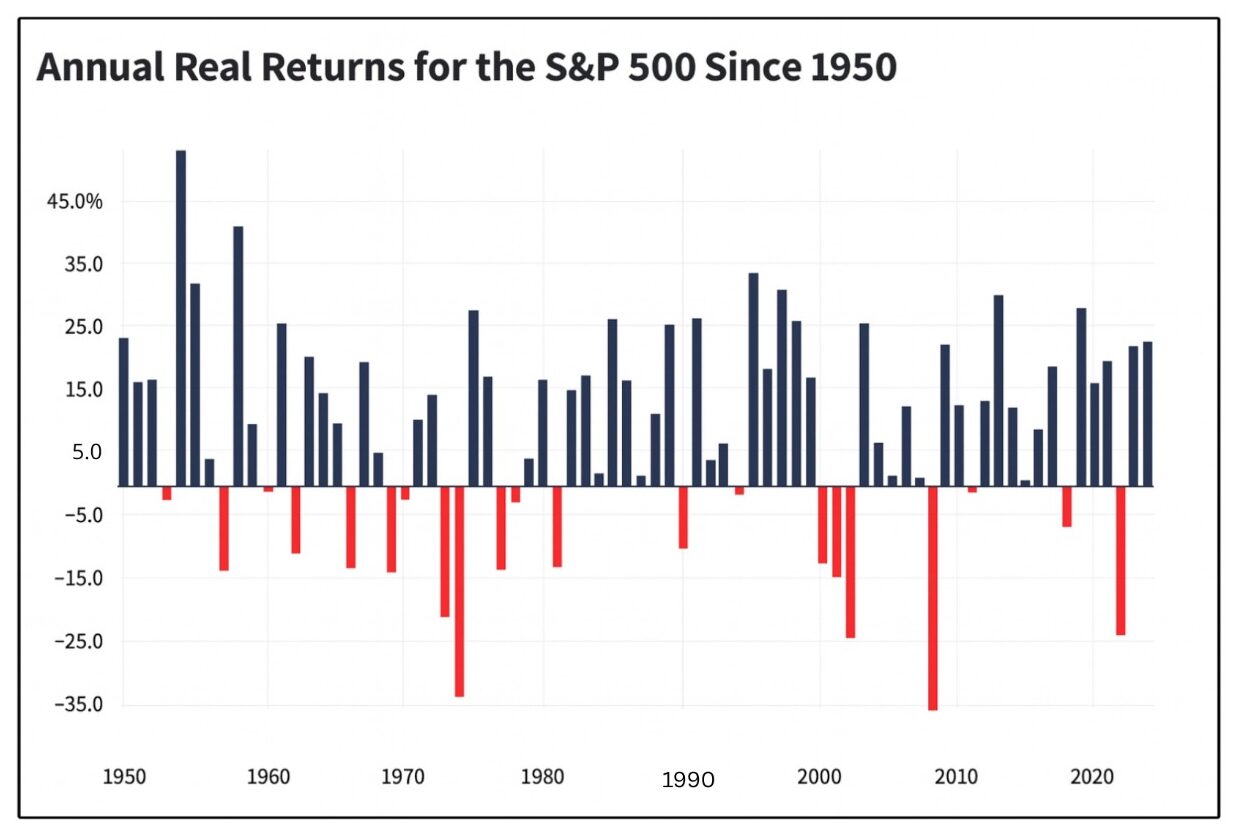

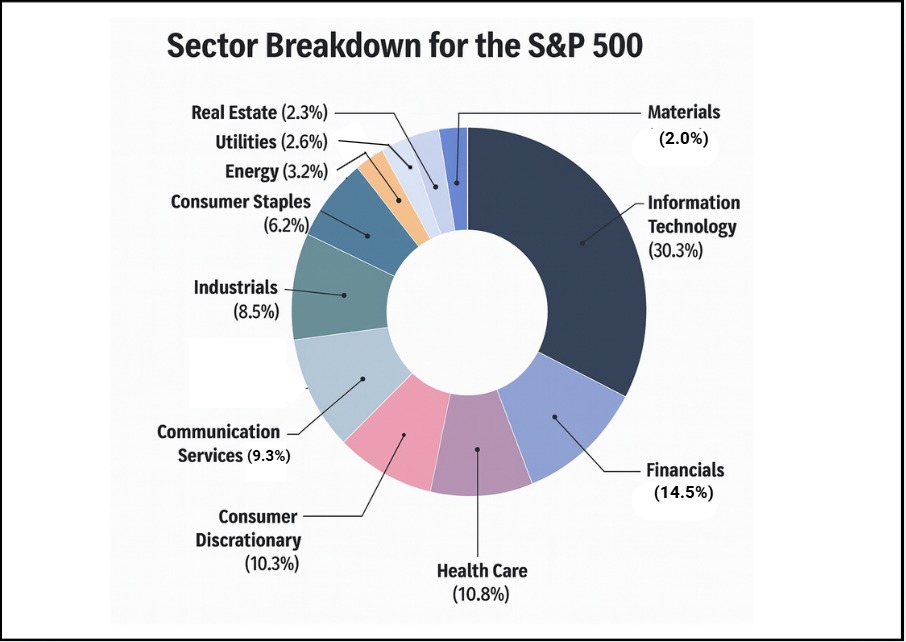

Below is a chart of the actual returns of the S&P 500 since 1950. The S&P 500 is an index that tracks the top 500 companies in the United States. Although there have been good and bad years, the average return from 1950 to 2025 is 10.83%

Please note that actual return can go up and down, and past performance is not a true indicator of future investment performance

Before setting up a savings or investment plan with any provider, it is always recommended to perform a detailed comparison of all providers in Ireland, so you can make the most informed decision & choose the provider that best suits your requirements.

As a fully Central Bank-regulated multi-agency financial brokerage, we only recommend providers who are also fully Central Bank of Ireland-regulated. This gives extra protection to as a customer.

College education savings plans in Ireland are typically provided through Life Assurance Companies.

These are the most common routes for long-term, tax-efficient savings plans.

Main providers include:

1.Fees and charges – where we analyse

2. Investment find options:

3. Flexibility of each Savings Plan: Access options, and if there are penalties applied for this access.

4. Customer Service support offered

This detailed comparison will be very useful to you before any provider is chosen.

Once you have made your decision, we will then assist you in submitting all of the necessary paperwork & documentation required to set up & start your savings or investment plan. If this service is something that may interest you, please schedule a call with one of our highly qualified Advisor Team.

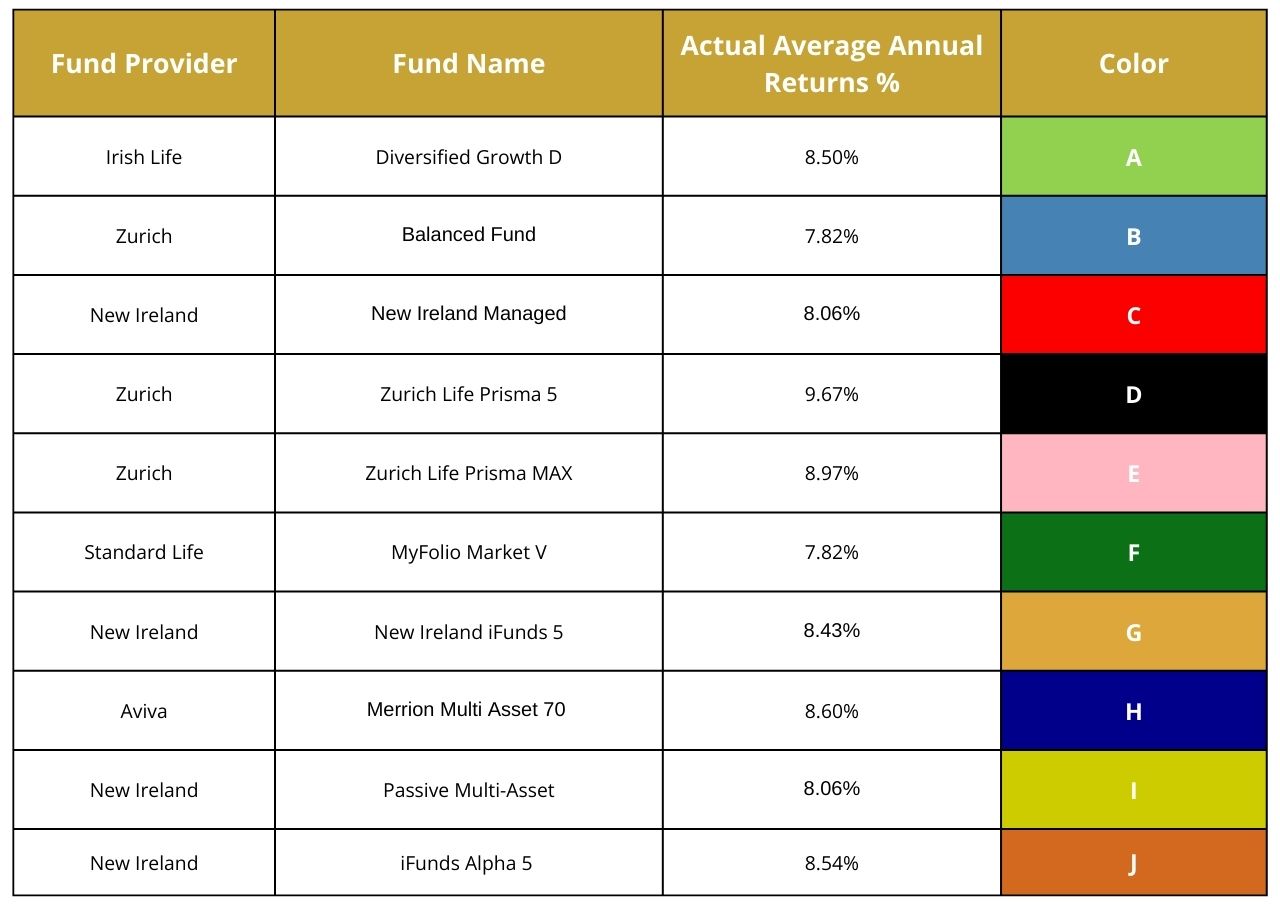

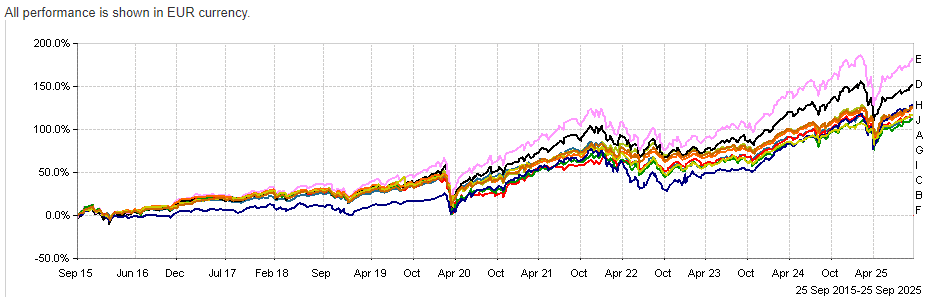

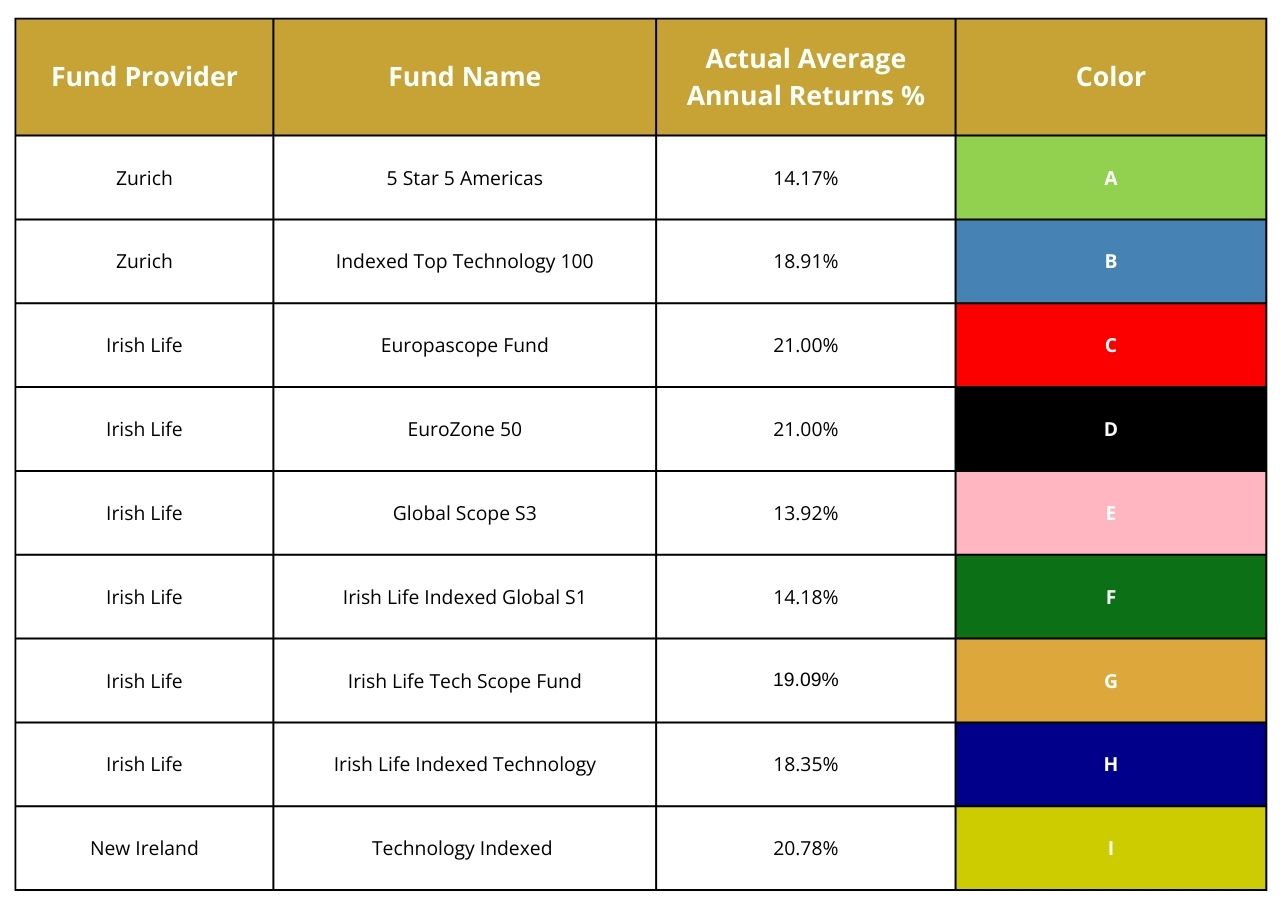

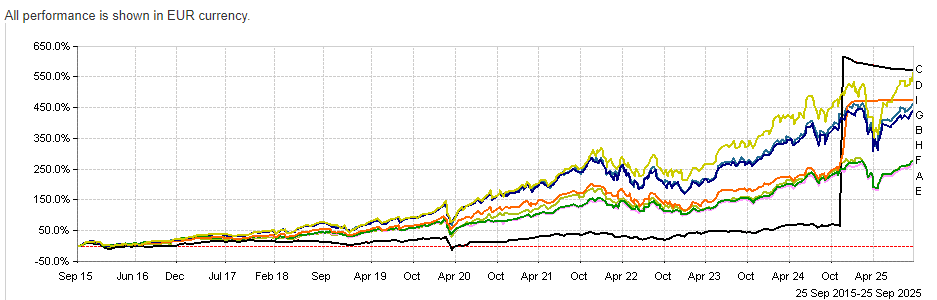

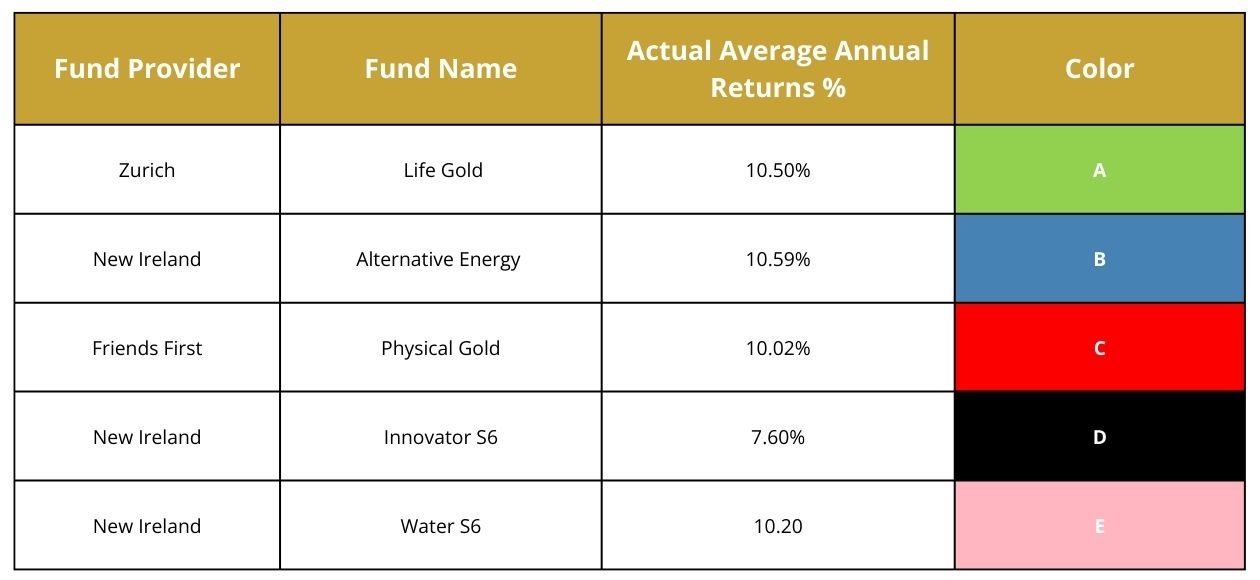

Below is a table of actual average annual returns over the past 10 years generated from some popular investment funds offered by these main providers for all savings plans.

Please note that actual return can go up and down,and past performance is not a true indicator of future investment performance

Please note that actual return can go up and down, and past performance is not a true indicator of future investment performance

Ans: Yes — but keep in mind:

Ans: Third-level education can cost up to €76,000 for a 4-year degree (incl. rent, food, books, travel).

Ans: If you want low risk, go for a savings account. If you want growth and inflation-beating returns, an education investment fund is a better long-term option.

Ans: Yes – even for domestic students. Tuition may be subsidised, but accommodation, supplies, transport, and food all add up quickly.

Planning for your child’s future is one of the most important responsibilities every parent carries. In Ireland, the rising cost of third-level education has made

College costs in Ireland are rapidly rising, leaving many families searching for ways to secure their children’s educational future. With third-level education expenses reaching over

A college savings plan in Ireland empowers parents to build an education fund for their child by investing small amounts monthly, such as the Children’s

Trustindex verifies that the original source of the review is Google. My wife and I had a very positive experience dealing with Mayank and Olga from Money Maximising. We'd like to thank them for their knowledge, professionalism and support.Posted onTrustindex verifies that the original source of the review is Google. I had a really positive experience dealing with Money Maximising Advisors Limited. Everything was explained clearly, the process was smooth, and I always felt well informed. Lorna was quick to respond to any questions I had. It made what can often feel like a complicated process very straightforward. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. I just got my remortgage through money Maximising with the help of Kavita,Maricris and Joy and I can't thank them enough. They were very helpful at the start and guided me throughout the process in a very professional and knowledgeable manner and were very prompt with email and telephone queries. They made the process very seamless and I'm definitely using them again in the future for all my financial needs..Posted onTrustindex verifies that the original source of the review is Google. I recently met and worked with Money Maximising Advisors and found Lorna & Anastasia to be exceptionally professional, knowledgeable, and efficient. Lorna provided clear guidance & insightful advice that helped me improve my investment options. I will definitely be returning in the future for further input and guidance on maximising my pension. Many thanks to the entire team for their support.Posted onTrustindex verifies that the original source of the review is Google. I remortgaged an investment property in 2025 with MM Advisors, I couldn't express highly enough how happy I was with the entire experience, the professionalism shown by Sean, Cris and Byran went above and beyond their duties. I would highly recommend your service to colleagues and friendsPosted onTrustindex verifies that the original source of the review is Google. Lovely to deal with, very good at keeping you in the loop. Highly recommend Cris and JackPosted onTrustindex verifies that the original source of the review is Google. I had a wonderful experience with Money Maximising Advisors Limited. They provided advice on the mortgage that best suited my needs and were very quick to respond to any queries. I would highly recommend their services.Posted onTrustindex verifies that the original source of the review is Google. Highly recommend Money Maximising Advisors. They helped us achieve our remortgage goals with good advise, constant updates and mortgage provider options. I'll recommend MMA to my friends & family who need money advice.Posted onTrustindex verifies that the original source of the review is Google. Trustable firm. Response time is quick. Clears each doubts thoroughly. Good listeners and Gives advice with multiple options. I bought mortgage protection from them with excellent rates.

If you would like assistance in starting a college education savings plan or comparing providers for this savings plan, please schedule a call with one of our highly qualified financial advisory team.

Money Maximising Advisors Limited is regulated by the Central Bank of Ireland – C154250