Redundancy Advice Kildare – The Ultimate Guide

The tech layoffs in companies like Facebook and Twitter have made people in the job market more anxious. Even people who still have their jobs

REDUNDANCY & PENSION GUIDANCE IN IRELAND

If you’re facing redundancy, understanding your financial entitlements is crucial. Your redundancy package can significantly impact your pension and future financial security. Our expert advisors help you navigate your options to maximise tax-free benefits and secure your long-term financial well-being.

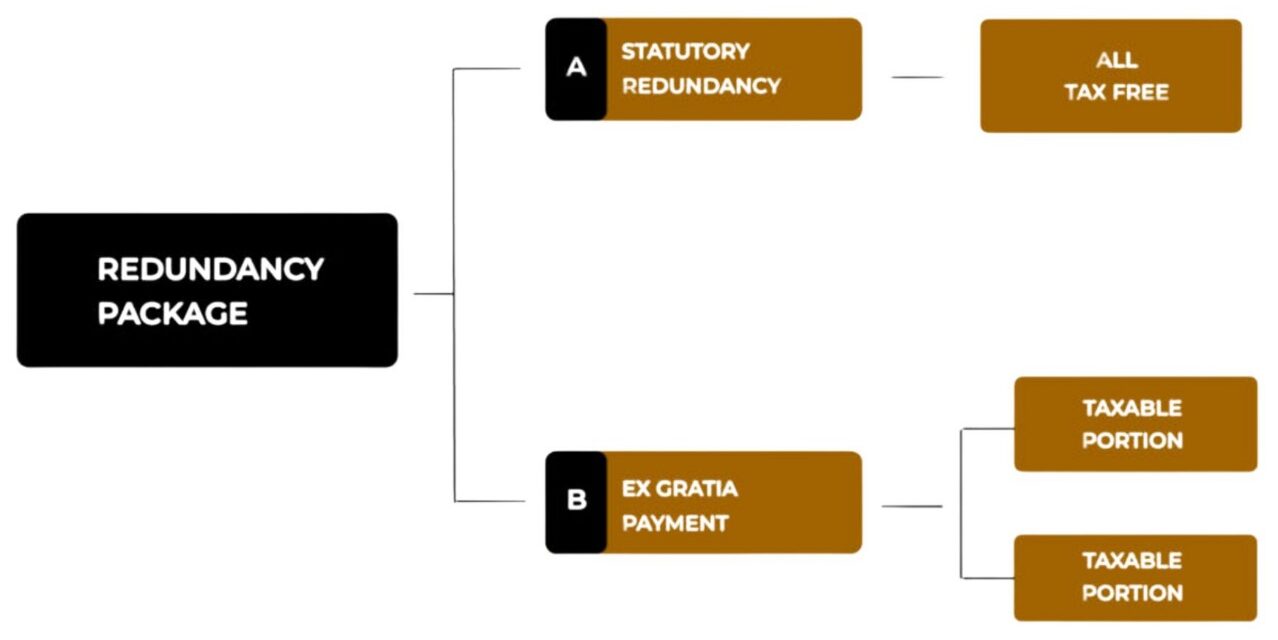

Your redundancy package typically includes:

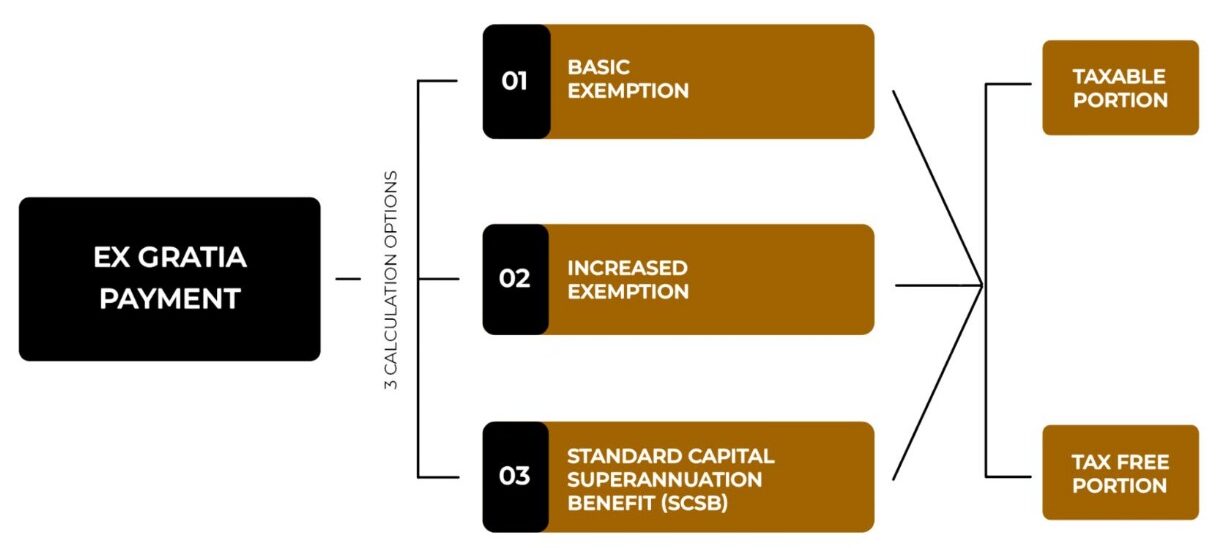

Tax-free amount: €10,160 + €765 for each completed year of service.

Tax-free amount: €10,160 + €765 per completed year of service + €10,000 (minus any previous redundancy or pension tax free lump sums received in past 10 years).

Tax-free amount: (Average earnings over the last 36 months × years of service) ÷ 15.

The SCSB calculation differs slightly if you waive or retain your pension lump sum. These calculations are

(average earnings over past 36 months x years of service)

(average earnings over past 36 months x years of service) 15 minus pension tax free lump sum

Upon leaving employment, you have several pension transfer options. Each choice impacts your tax benefits and accessibility to funds.

If you choose an increased tax-free redundancy payment by waiving your pension lump sum, you can only regain a tax-free lump sum if you transfer your pension into a PRSA. None of the other transfer options allow for a tax free pension lump sum.

Transferring your pension into a PRSA ensures you retain your tax-free lump sum entitlement (25% of the transfer value).

Transferring from an occupational pension scheme (Defined Benefit or Defined Contribution) into a PRSA requires an Independent Statement of Comparison of Benefits Report. Only a limited number of authorised companies in Ireland provide this report to meet Revenue requirements.

Choosing the right redundancy and pension transfer option is essential to protect your financial future. Many redundancy package calculations overlook long-term pension implications, leading to costly mistakes. Our expert financial advisors provide personalised guidance to help you:

The tech layoffs in companies like Facebook and Twitter have made people in the job market more anxious. Even people who still have their jobs

Whether you’re just starting or managing a growing portfolio, our advisors are here to help. Let us guide you to the right provider, the best rates, and a future full of property investment success.

Money Maximising Advisors Limited is regulated by the Central Bank of Ireland C154250